EURUSD Daily Pivots

| R3 | 1.1235 |

| R2 | 1.1165 |

| R1 | 1.1109 |

| Pivot | 1.1039 |

| S1 | 1.0983 |

| S2 | 1.0913 |

| S3 | 1.0858 |

EURUSD (1.103): EURUSD closed on a bullish note yesterday despite opening weak. Daily charts price action still remains range bound within last week’s high and low and therefore we keep our options open on the bias until there is a more clear confirmation. On the intraday charts, the bear flag pattern looks to be in place despite the bounce off 1.095, which incidentally marks the 127.2% Fib level of the bearish flag pattern. The bounce from 1.095 saw retest to the break out level and a decline. We expect another leg down to 1.095, and the potential test to 1.09275 which will complete the bear flag’s measured move. If support at 1.095 holds, we could expect a possible break out from the falling price channel and could shift the bias to the upside.

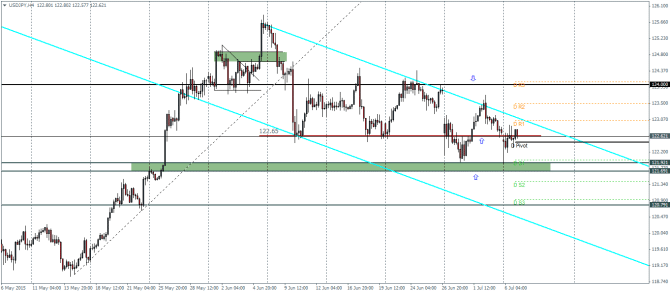

USDJPY Daily Pivots

| R3 | 124.073 |

| R2 | 123.496 |

| R1 | 123.037 |

| Pivot | 122.46 |

| S1 | 121.988 |

| S2 | 121.411 |

| S3 | 120.939 |

USDJPY (122.65): USDJPY closed as a near doji type of a candlestick pattern yesterday. On the intraday charts, price is still hovering near 122.65 region of support/resistance after a bullish engulfing was formed few sessions ago. A close below 122.65 could test previous lows near the support at 122 and could potentially see a further decline down to 120.8 should the support zone near 122 – 121.7 give way.

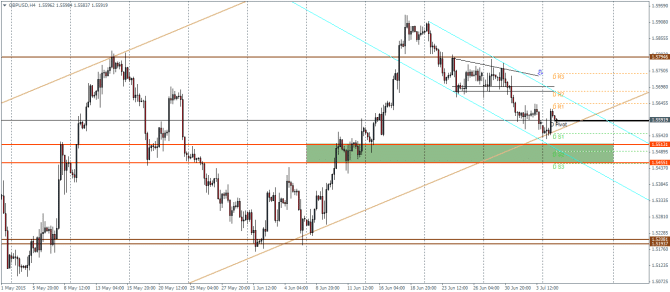

GBPUSD Daily Pivots

| R3 | 1.5742 |

| R2 | 1.5685 |

| R1 | 1.5645 |

| Pivot | 1.5588 |

| S1 | 1.5549 |

| S2 | 1.5492 |

| S3 | 1.5452 |

GBPUSD (1.558): GBPUSD closed on a piercing line candlestick pattern yesterday and comes just a few pips above 1.552. We could expect a possible correction to the upside in the near term. On the intraday charts, price bounced off the lower rail of the rising price channel and we can expect a test back to the broken support near 1.5685 region. There is a likelihood of a test of support near 1.551 as noted by the new falling price channel within the larger one. A break of this falling price channel could indicate a potential move to the upside which will see GBPUSD set up for a test back to 1.5685 and possible back to 1.58.

In our latest podcast we feature a Greferendum preview, NFP review and more

Follow us on Sticher.