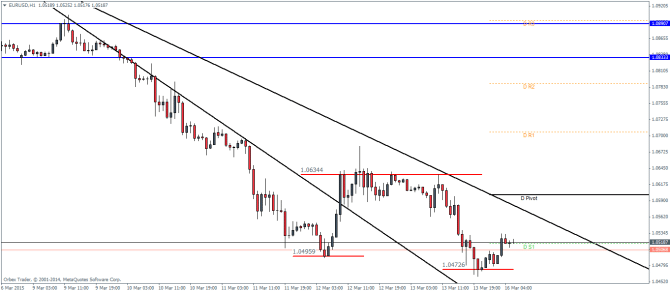

EURUSD Daily Pivots

| R3 | 1.0895 |

| R2 | 1.0789 |

| R1 | 1.0705 |

| Pivot | 1.0599 |

| S1 | 1.0515 |

| S2 | 1.0410 |

| S3 | 1.0326 |

EURUSD dropped to make a new lower low at 1.04726 but managed to reverse from there on. Price action is currently back near the previous low at 1.04959. If this resistance holds, we could expect EURUSD to push lower on break of 1.04726. Alternatively, if the support below holds, EURUSD could test the daily pivot level.

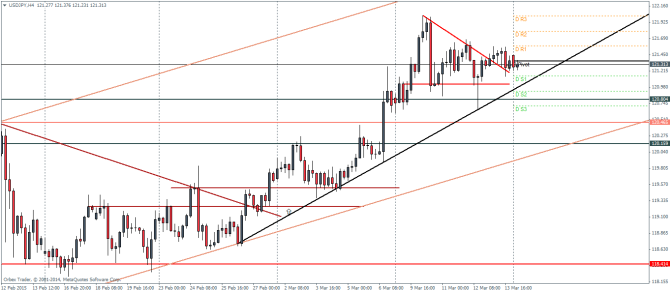

USDJPY Daily Pivots

| R3 | 122.013 |

| R2 | 121.792 |

| R1 | 121.578 |

| Pivot | 121.357 |

| S1 | 121.143 |

| S2 | 120.922 |

| S3 | 120.708 |

USDJPY broke out from the triangle consolidation pattern but looks to be back close to the lower support level. However, price action is well supported with the trend line as well, which should help keep prices to push higher. To the downside, there is a strong support formed at 120.8, which looks unlike to be broken for the moment. The upside targets for USDJPY is currently eyeing the highs above 122 levels.

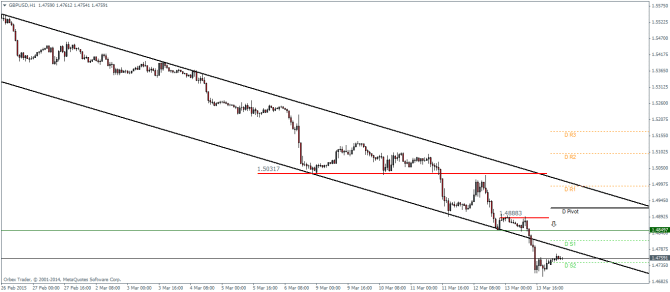

GBPUSD Daily Pivots

| R3 | 1.5169 |

| R2 | 1.5097 |

| R1 | 1.4992 |

| Pivot | 1.4921 |

| S1 | 1.4816 |

| S2 | 1.4745 |

| S3 | 1.4639 |

GBPUSD is currently consolidating outside of the price channel, having broken from it from the lower support line. If price action continues higher, we could see a test to the broken support at 1.485 levels before the declines starts again. The rally should potentially stall near the highs above 1.48883 levels, failing which, we could see a further retest towards 1.50 levels.

In our latest podcast, we discuss QE: Who got it right, Krugman or the Gold bugs?