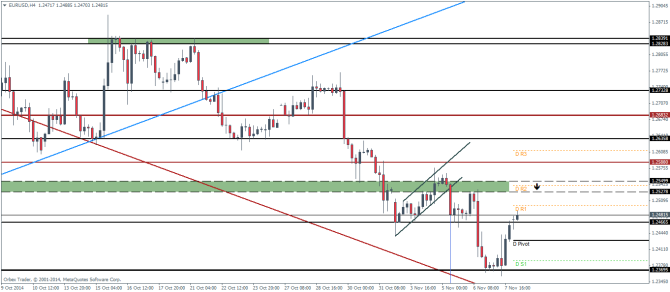

EURUSD Daily Pivots

| R3 | 1.2611 |

| R2 | 1.254 |

| R1 | 1.2499 |

| Pivot | 1.2428 |

| S1 | 1.2388 |

| S2 | 1.2316 |

| S3 | 1.2271 |

As mentioned in the previous daily analysis, EURUSD managed to rally back to test the previous broken support at 1.2466. Further upside gains could likely stall near the break out price level of the bearish flag near 1.25278 for a move back towards the lows of 1.2271 level. Alternatively, a break of resistance near 1.25278 could see a rally1.26358

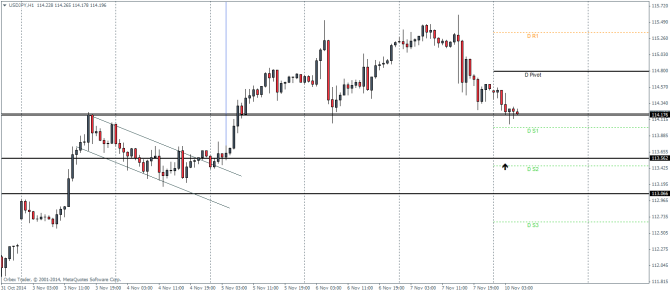

USDJPY Daily Pivots

| R3 | 116.682 |

| R2 | 116.138 |

| R1 | 115.343 |

| Pivot | 114.799 |

| S1 | 114.004 |

| S2 | 113.46 |

| S3 | 112.665 |

USDJPY weakened since Friday’s close and looks set to test the region near the daily support 2 level of 113.460, the break out level of the bullish flag. However, a break of 114.176 is required in order to achieve this objective. If 113.46 manage to hold, we could see USDJPY rally towards the daily pivot level before declining further.

GBPUSD Daily Pivots

| R3 | 1.6009 |

| R2 | 1.5948 |

| R1 | 1.5913 |

| Pivot | 1.5851 |

| S1 | 1.5816 |

| S2 | 1.5755 |

| S3 | 1.5720 |

As expected from the previous analysis, GBPUSD did manage to rally back towards the region of 1.5872. Having broken this level, GBPUSD could test it for support for further upside moves towards the next resistance level of 1.595. Alternatively, a break of the support at 1.5872 could see the Cable decline towards 1.58 followed by 1.5742