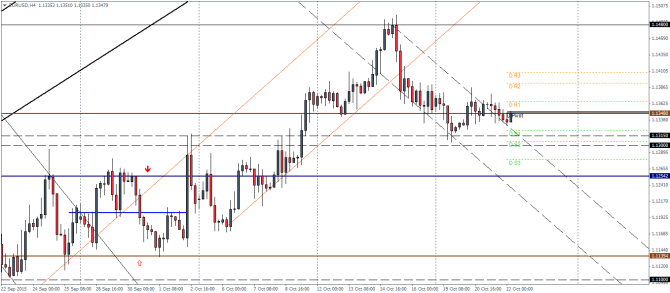

EURUSD Daily Pivots

| R3 | 1.1409 |

| R2 | 1.1392 |

| R1 | 1.1365 |

| Pivot | 1.1349 |

| S1 | 1.1322 |

| S2 | 1.1306 |

| S3 | 1.1279 |

EURUSD (1.13): EURUSD is trading flat for the past few sessions on the daily charts and the ranging price action is indicative of a potential breakout in the near term. 1.1348 remains a key level to watch as a close above this support/resistance will signal a further strong momentum based move. To the upside, 1.148 remains a level that could be targeted should 1.1348 turn to support, while to the downside, there is a strong support at 1.1315 – 1.130 which could hold the declines. In the event prices break below this support zone, EURUSD could decline to as low as 1.1254.

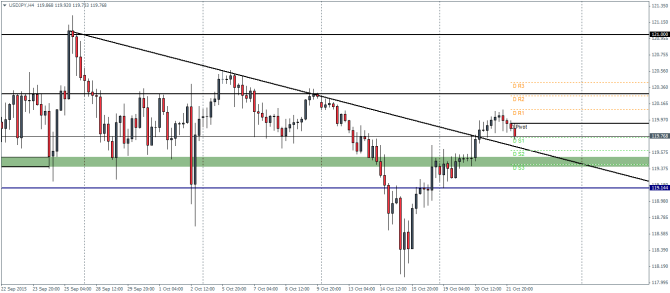

USDJPY Daily Pivots

| R3 | 120.419 |

| R2 | 120.258 |

| R1 | 120.091 |

| Pivot | 119.923 |

| S1 | 119.756 |

| S2 | 119.594 |

| S3 | 119.427 |

USDJPY (119.7): USDJPY has now gained for the 5 consecutive daily sessions. A bearish close today could potentially signal further downside moves to come. Support is at 119.45 which if holds could see the declines being held for the moment. With the falling trend line being broken, USDJPY could look towards a further rally to the next level of resistance at 120.275 and eventually to 121. The 4-hour charts shows a limited downside for USDJPY and only a close below the trend line and the support level at 119.4 will indicate a decline lower.

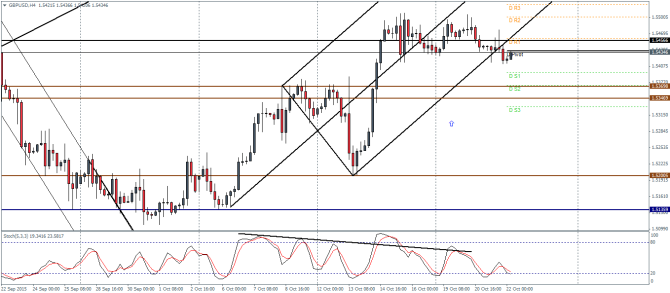

GBPUSD Daily Pivots

| R3 | 1.5524 |

| R2 | 1.5500 |

| R1 | 1.5459 |

| Pivot | 1.5436 |

| S1 | 1.5395 |

| S2 | 1.5371 |

| S3 | 1.5330 |

GBPUSD (1.54): GBPUSD continues to trade flat with no bias being established as yet. However, prices have broken out of the median line after failure to rally to the median line and the eventual breakout of prices from the lower median line. A decline to 1.537 through 1.535 is very likely. A test of support here could see GBPUSD continues to trade sideways within the identified support and resistance levels. A break below 1.535 could see GBPUSD fall to lower support at 1.52, while to the upside support needs to be established at 1.5355 for further confirmation to the rally.