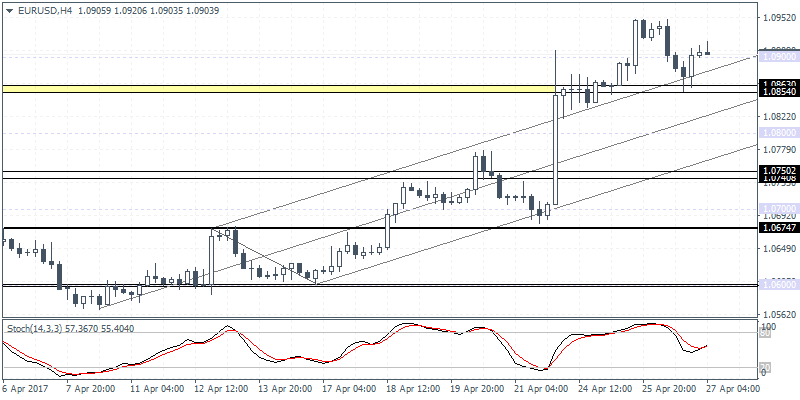

EURUSD intra-day analysis

EURUSD (1.0903): EURUSD formed an outside bar yesterday which comes after two straight days of solid gains posted by the common currency. With the ECB meeting due later today, the euro could be seen coming under pressure. The recent weakness in the inflation data could possibly keep the ECB on a dovish tone although there is potential for central bank officials to acknowledge that recent pickup in the economic activity. Unless EURUSD breaks out above 1.0941 to post a new high, we can expect to see a correction in store. A breakdown below 1.0850 will trigger further downside towards 1.0750 – 1.0740 where there initial support exists followed by a move towards 1.0675.

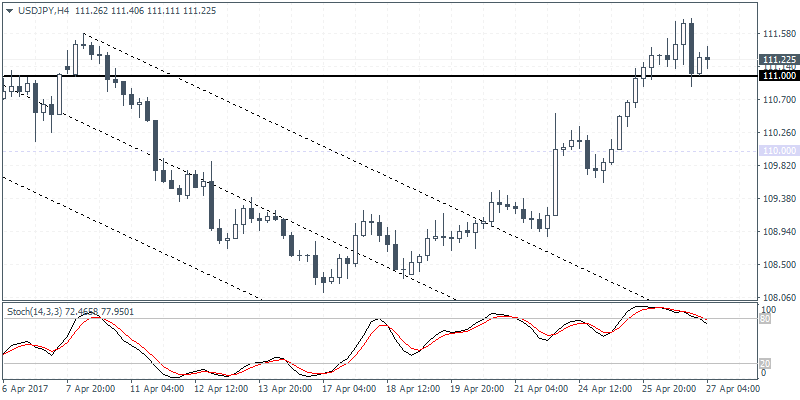

USDJPY intra-day analysis

USDJPY (111.22): USDJPY closed with a doji candlestick pattern yesterday, and this could signal a possible decline in the coming sessions. For the short term, the BoJ’s monetary policy decisions could bring some volatility but expect further downside in USDJPY on a break down below the immediate support level at 111.00. The breakdown below 111.00 will possibly push USDJPY lower to test the next lower support at 110.00 in the near term.

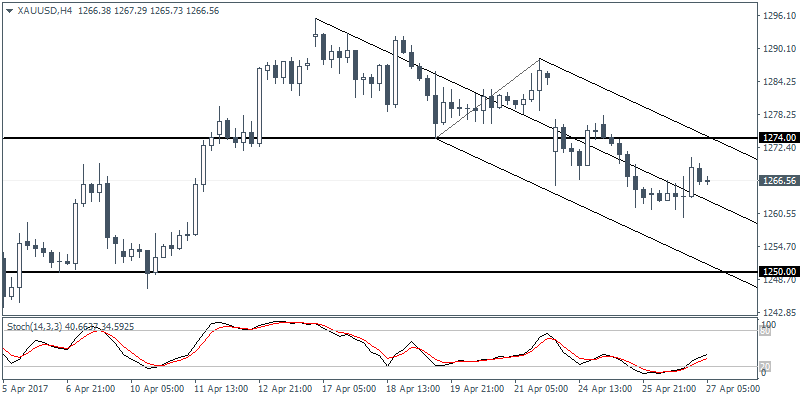

XAUUSD intra-day analysis

XAUUSD (1266.56): Gold prices continue to remain biased to the downside with the next destination likely coming in at the support level of 1250.00.

In the near term, we can expect a short-term retracement as long as the previous lows formed at 1259.83 holds. To the upside, gold prices could be seen testing 1274.00, and a possible breakout above this level could signal a move towards the unfilled gap from last Friday at 1284.87.