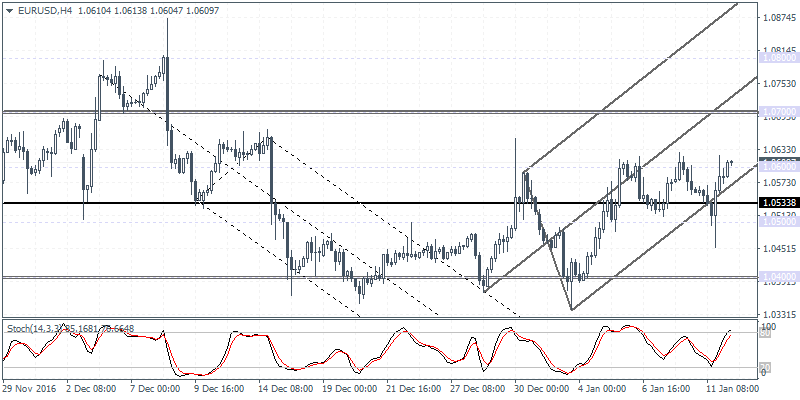

EURUSD intra-daily analysis

EURUSD (1.0609): EURUSD managed to slip below the support level at 1.0500 before pushing higher with the price now seen trading at 1.0600 handle. This could signal further upside in the near term with the support at 1.0551 likely to hold up the prices for the moment as the single currency could be seen targeting 1.0700. On the 4-hour chart, price action is showing signs of a potential ascending triangle pattern within the rising median line which puts the minimum upside target to 1.0800 following the break of the strong resistance at 1.0700.

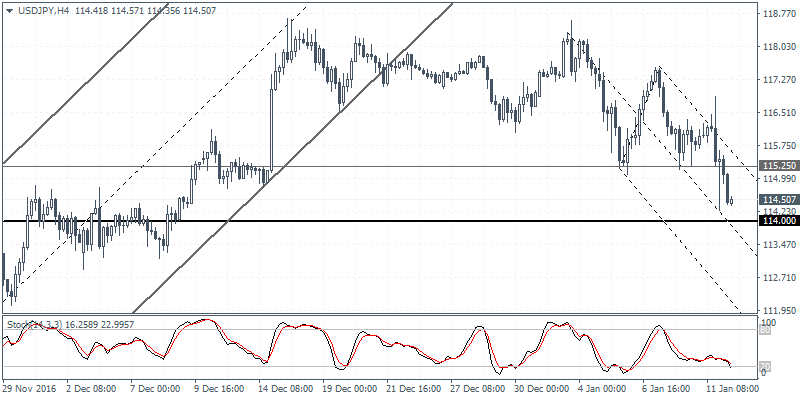

USDJPY intra-day analysis

USDJPY (114.50): USDJPY is seen approaching the 114.00 support level after prices topped out near 118.00. Expect a short-term bounce off 114.00 on the initial test of this level which previously acted as resistance. However, the upside could be limited in the near term with USDJPY likely to stay range bound within 116.00 and 118.00 levels. The daily Stochastics looks to be edging closer to the oversold levels which could see a short term bounce ahead of further declines. On the 4-hour chart, USDJPY could be seen retesting the 115.25 price level to establish resistance following which the dollar is looking weaker as it could potentially test 109.75 – 109.50 support to the downside.

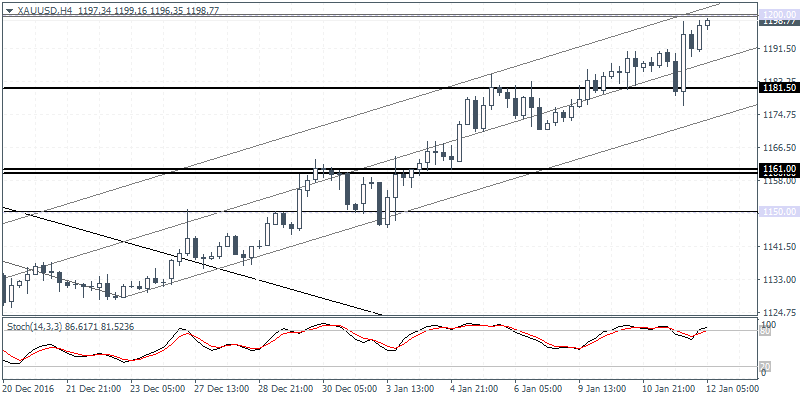

XAUUSD intra-day analysis

XAUUSD (1198.77): Gold prices are trading close the 1200.00 handle which could see this strong correction finally reach its intended target. Further upside can be seen coming only on a convincing close above 1200.00, but there is scope for a pullback following the retest to the round number resistance level. The daily Stochastics is now confirming the hidden bearish divergence which could signal a correction lower. On the 4-hour chart, gold prices posted a pullback to 1181.50 and posted a strong reversal off this level. For the moment, watch for a reversal near 1200.00, as gold prices could see some downside momentum potentially push prices lower back to 1160 – 1161.00.