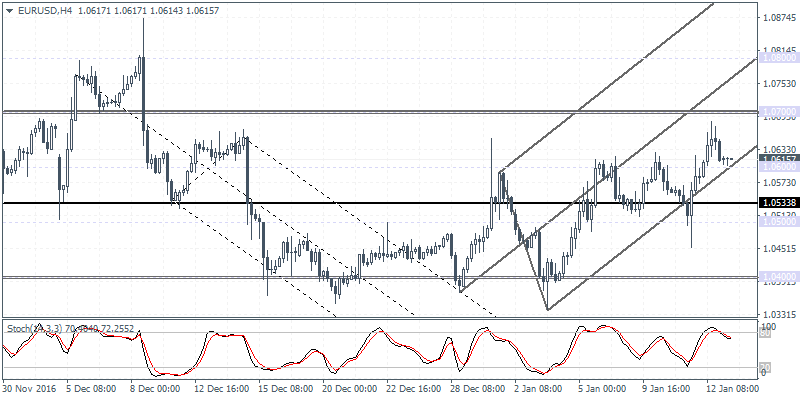

EURUSD intra-daily analysis

EURUSD (1.0615): EURUSD rallied to highs of 1.0684 yesterday before giving up some of the gains. The euro remains poised for a move towards testing the resistance level at 1.0700 but the current price action could see a potential pull back towards 1.0600. The ascending triangle pattern puts EURUSD to the upside for a minimum target to 1.0800. In the near term watch for EURUSD to consolidate between the price levels of 1.0600 and 1.0500. The bullish bias will be invalidated on a close below 1.0500.

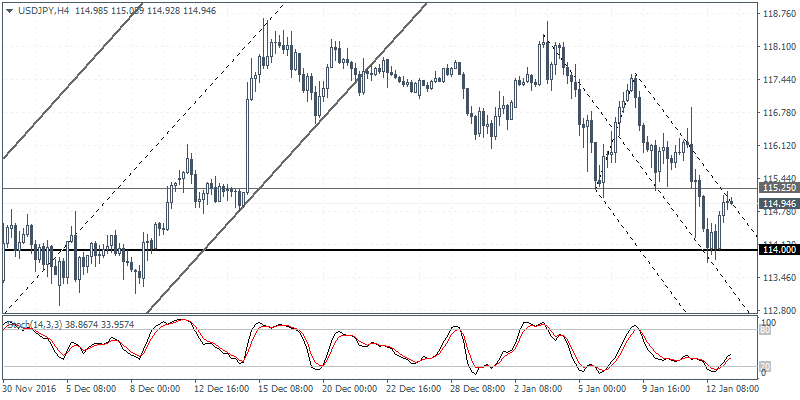

USDJPY intra-day analysis

USDJPY (114.94): USDJPY fell to a 5-week low yesterday to briefly test 113.75 near the 114.00 support level. The dollar managed to close the day at 114.70, just above the marked support level. In the near term, USDJPY could see a potential retest towards 116.00 but further downside could be expected on a break down below the main support level at 114.00. On the 4-hour chart, USDJPY is seen consolidating below the support level of 115.25 with the recent 4-hour session close with a doji. A bearish follow through here could signal further downside with prices likely to accelerate on a break down below 114.00.

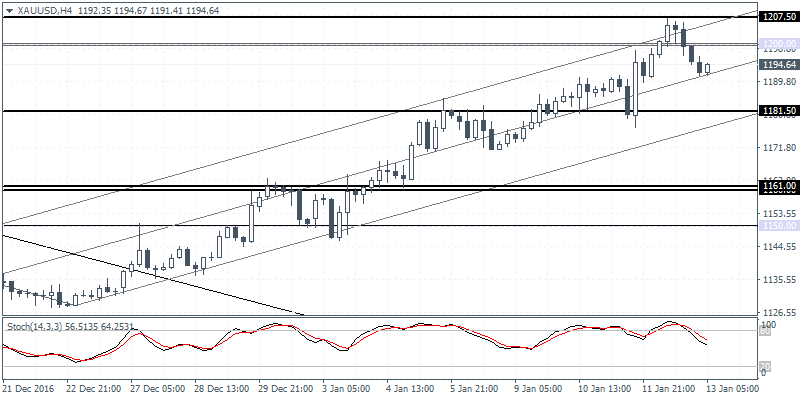

XAUUSD intra-day analysis

XAUUSD (1194.64): Gold prices broke above $1200 an ounce handle yesterday but the retest to this resistance saw a quick reversal as price retreated sharply lower. Short term support is being seen near 1192.55 which could see gold prices move sideways below the 1200.00 handle. Watch the Stochastics on the 4-hour session which could be posting a bearish divergence, failing to confirm the highs in prices. Gold prices remain poised for a pullback with support seen at 1181.50 followed by 1161.00 – 1160.00.