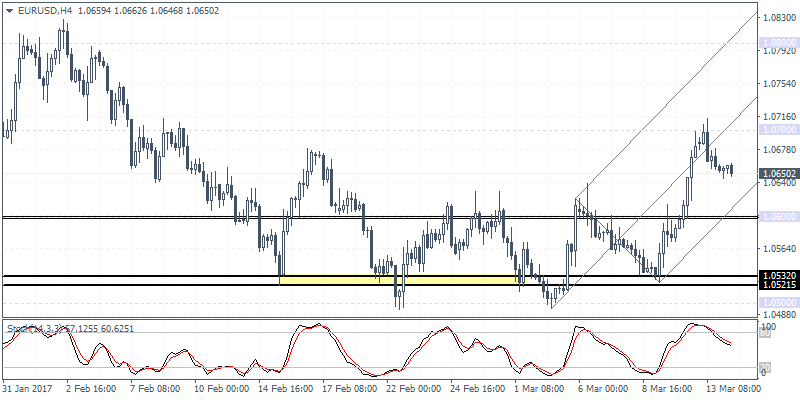

EURUSD intra-day analysis

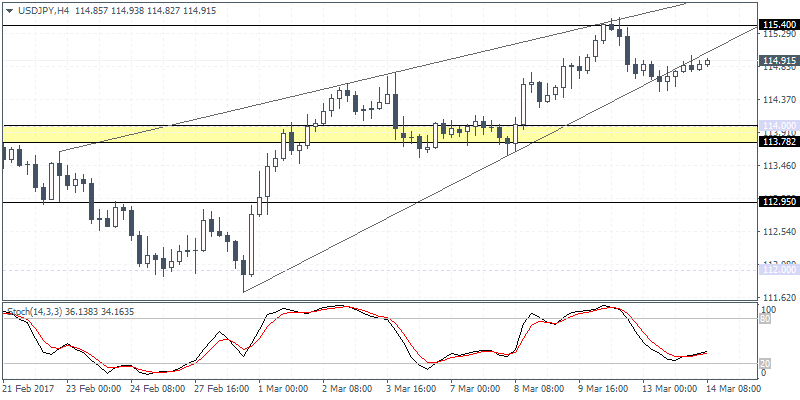

USDJPY intra-day analysis

USDJPY (114.91): USDJPY is seen attempting to push higher following the breakout from the rising trend line. The bias remains lower and could be validated on a lower high that could be formed on the current up-leg. Watch for USDJPY to retest and possibly reverse near 115.00 as price action could resume its declines towards 114.00 – 113.78 support level. In the event of a continued breakdown, USDJPY could be seen testing 112.95 support region. The yen could come back in favor ahead of the Fed meeting and the Dutch vote tomorrow.

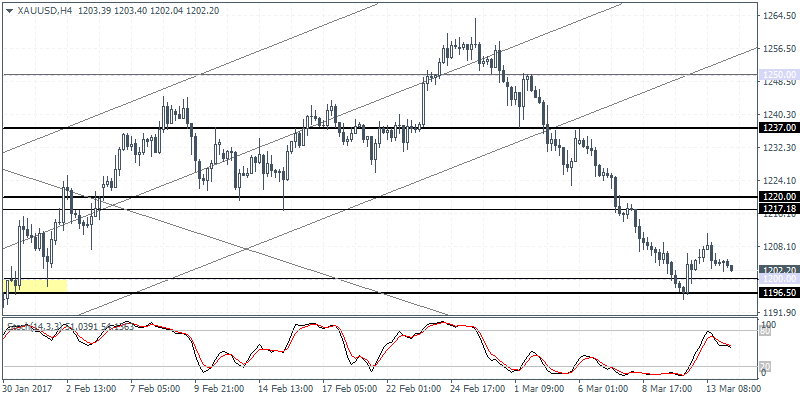

XAUUSD intra-day analysis

XAUUSD (1202.20): The initial attempt to bounce off 1200 support looks to be fading as gold prices are looking weaker following the intraday test to 1211 highs yesterday. Gold could be seen falling back to the 1200 handle in the near term as the 4-hour chart shows the hidden bearish divergence, with the Stochastics printing a higher high against the price’s lower high. The support zone of 1200 – 1196.50 could hold the declines for the moment. However, in the event of a break down below 1196.50, expect to see further declines towards the 1175.00 handle. To the upside, gold prices could be seen testing 1217 – 1220 resistance followed by 1237.00.