The dollar managed to stabilize after the falls but is still far from the highs. What is the next direction for the greenback?

ING sees emerging opportunities to buy the dollar against both the euro and the yen.

Here is their view, courtesy of eFXnews:

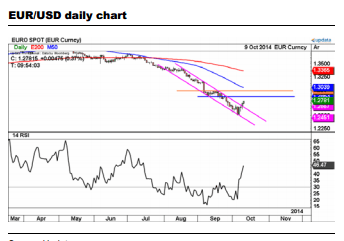

EUR/USD’s is back trading around the steep falling trend line around 1.2690, notes ING.

“The hourly chart shows the completion of a minor bottom formation above the horizontal resistance at 1.2685, likely suggesting further upside with a short-term price target of around 1.2870. The daily chart shows strong horizontal resistance coming in between 1.2860 and 1.2975 with the sharp declining MA-50 line at 1.3038,” ING adds.

All in all, despite recent short-term development, ING considers this in the context of a longer-term lower top within the downtrend before the next decline begins.

“Therefore, we stick to our ‘Down’ rating, waiting for the next bearish set-up,”ING advises.

In USD/JPY, ING notes that the consolidation pattern in the uptrend extends with prices trading now around 107.75 within this process.

“The downside potential is limited with the daily chart showing next horizontal support coming in around 107.40-106.80 with the rising MA-50 line at 105.70,” ING projects.

“We recommend buying the dips within this consolidation,” ING advises.

For lots more FX trades from Credit Agricole and other major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.