Both EUR/USD and USD/JPY are experiencing interesting patterns on their charts.

Taking a technical look at both major pairs, the team at Nomura see more potential for the US dollar.

Here is their view, courtesy of eFXnews:

The down channel in EUR/USD is still in force from 1.26 and now there is strong resistance at 1.1864, notes Nomura.

“Another convincing break of 1.1754 can set the stage for a fresh drop to 1.1713/1640 which are levels from the monthly chart that represent the next support zone,” Nomura projects.

“From a wave perspective, if wave-4 is complete as labeled, then wave-5 lower is underway and can sport another impulse lower. For today initial resistance is right here at 1.1864; support is 1.1713,” Nomura adds.

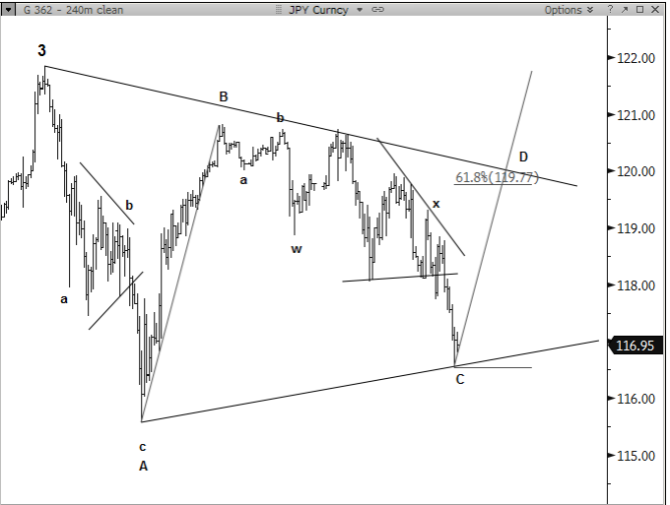

In USD/JPY, Nomura favored a flat rather than a triangle to explain this wave-4 consolidation.

“The drop below 118 promotes the alternate idea and we are now shifting to the bull triangle interpretation. The ideal target for wave-C in this coil is 116.95 but the pattern remains valid above 116.30/115.57,” Nomura argues.

“The reason we view this is a bullish consolidation is because of the choppy declines (from 121.85 and 120.85) against the trend that are the hallmark of corrections. S/t, support is 116.30/115.57,” Nomura clarifies.

“Resistance is 117.74 and then 118.85; above those levels can signal a wave-D rally to 119.77,” Nomura projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.