EURUSD Daily Analysis

EURUSD (1.1017): EURUSD has been posting a steady decline for the past three days with price action breaking clear of the 1.1100 support level. The further downside can be expected in EURUSD which could be seen targeting 1.0900 support. However, in the interim, expect prices to post a modest rebound off the 1.1000 round number psychological support. This could potentially see EURUSD rallying back to the 1.1100 level to establish resistance. The bearish case could be invalidated if price breaks out of the falling median line above 1.1100 resistance.

XAUUSD Daily Analysis

XAUUSD (1260.56): Gold prices fell back to the 1250 handle yesterday as expected and the current bullish momentum is likely to continue to the upside with a daily bullish close today likely to confirm the upside. On the 4-hour chart, 1264.85 will be a key level to watch as further upside can be seen coming only on a breakout to the upside. Ahead of the expected correction to 1300 which needs to be tested for resistance, 1278 is a minor level that will be challenged in the near term. Look for any bounce off the 1264.85 price level to confirm further upside.

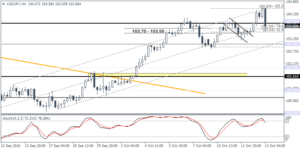

USDJPY Daily Analysis

USDJPY (103.80): USDJPY closed bullish above 104.00 resistance coming off the previous day’s doji candlestick. However, further upside looks unlikely after prices broke out from a minor cup and handle pattern, rallying to 104.57 highs before quickly reversing the gains. A bearish close on the 4-hour chart below 104.00 could confirm the anticipated correction lower. Watch for short term support levels at 103.00 ahead of a larger correction to 102.00 and 101.60. The re-adjusted median line shows that prices could be posting a rebound off 103.00 support which will put a retest back to 104.00 into focus for a test of resistance. All in all, look for another short-term reversal off 103.00 back to 104.00 for a confirmation of a lower high.