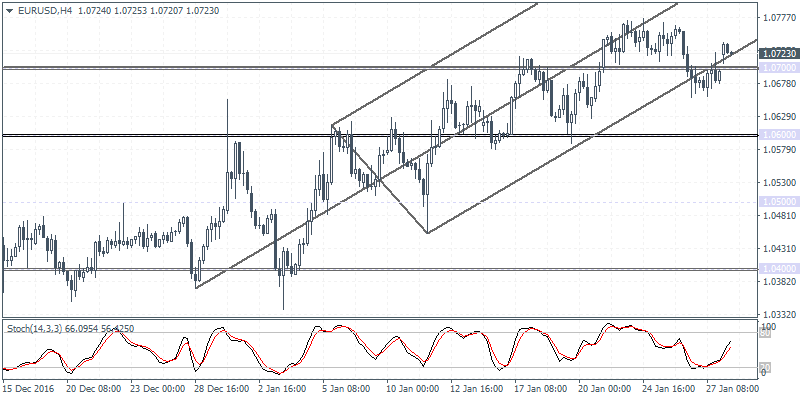

EURUSD intra-day analysis

EURUSD (1.0723): EURUSD gapped higher on today’s open but the 4-hour session closed with an inside bar formation after prices gapped above 1.0700. The inside bar breakout will be crucial as it could set the near-term direction in prices. The bias remains to the downside within the overall trend for a corrective move towards 1.0600 at the very least. Still, watch for a break down below 1.0700 for this to be confirmed. The 4-hour chart Stochastics is starting to develop the bearish divergence with the Stochastics printing a lower high, indicative of a corrective move towards 1.0600.

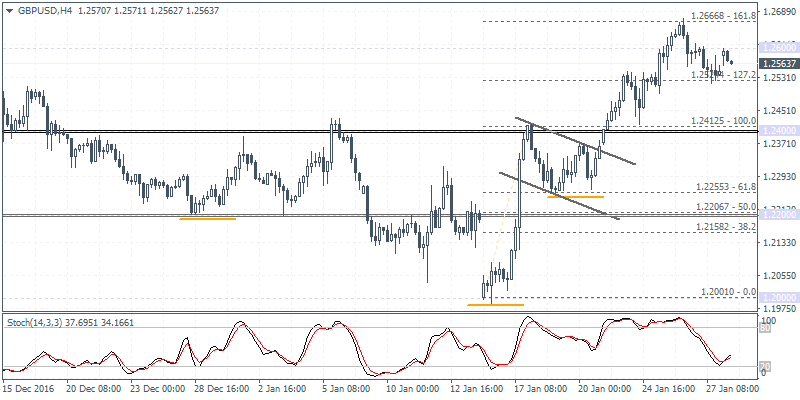

GBPUSD intra-day analysis

GBPUSD (1.2563): GBPUSD continues to remain bearish in today’s early Asian trading following last week’s two consecutive bearish close on Thursday and Friday. The downside bias towards 1.2400 is likely where support can be established at the level that previously acted as resistance. A retest towards 1.2400 will ascertain further gains in GBPUSD towards 1.2800 on the inverse head and shoulders pattern. However, watch for price action near 1.2400 as a breakdown below this support could signal further corrections and put the bullish bias at risk.

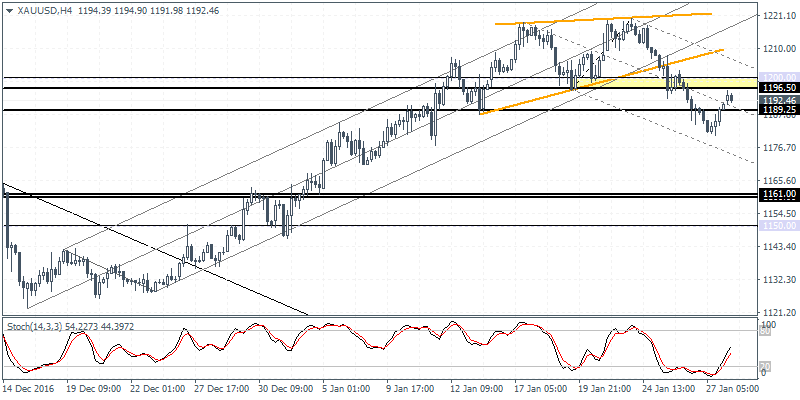

XAUUSD intra-day analysis

XAUUSD (1192.46): Gold prices are looking to retest the $1200 price level where resistance could be established following last week’s breakdown below this price level. On the 4-hour chart, the retracement could, however, lose steam with the Stochastics showing a strong hidden bearish divergence at the current levels above 1189.25. However, watch for a reversal near 1197.50 – 1200 region where gold prices could retrace before reversing and resuming the declines. A breakdown below 1189.25 could signal further declines down towards 1161.00 in the medium term.