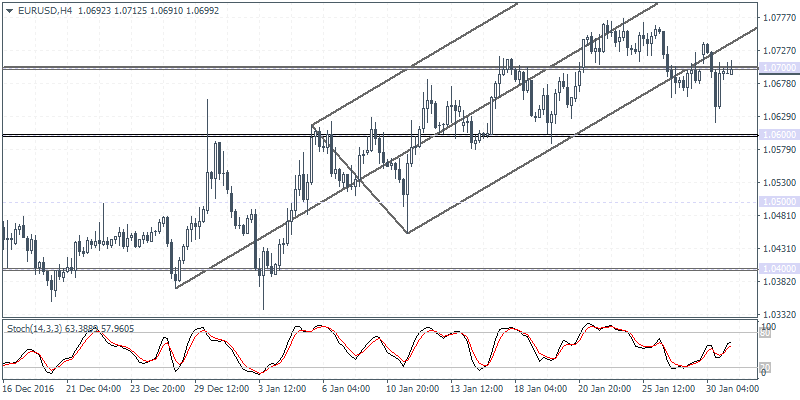

EURUSD intra-day analysis

EURUSD (1.0699): EURUSD remained choppy in yesterday’s trading as the price fell to a 7-day low of 1.0621 before recovering by the end of the trading day. Price action in EURUSD is struggling to break out from the 1.0700 resistance level that has formed now. The euro fell for the most part of the day as Germany’s preliminary inflation data showed 0.6% monthly decline in inflation but the annual inflation rate rose 1.9%. On the 4-hour chart, the bearish divergence continues to play out with the lower high on the Stochastics. The bias remains to the downside as long as 1.0700 resistance holds out, which puts the downside towards 1.0600.

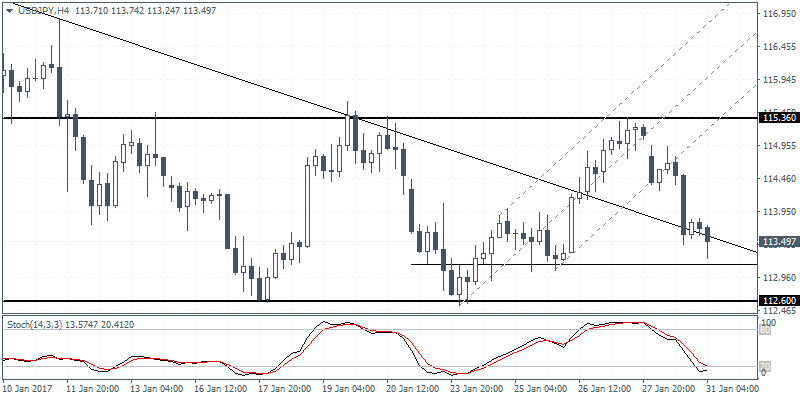

USDJPY intra-day analysis

USDJPY (113.49): USDJPY is seen extending the declines from yesterday although price action on the daily chart remains flat following the decline off the top formed near 118.00. On the 4-hour chart, USDJPY is seen finding support from the falling trend line which was broken earlier this month sending prices briefly trending higher towards 115.00. The retest at the current levels of 113.50 – 113.00 is marked with a confluence of the trend line and the horizontal support. The Stochastics on the 4-hour time frame is also currently moving out from the oversold levels, which points to a potential rebound in prices. Look for Friday’s gap at 115.106 likely to be filled in the near term.

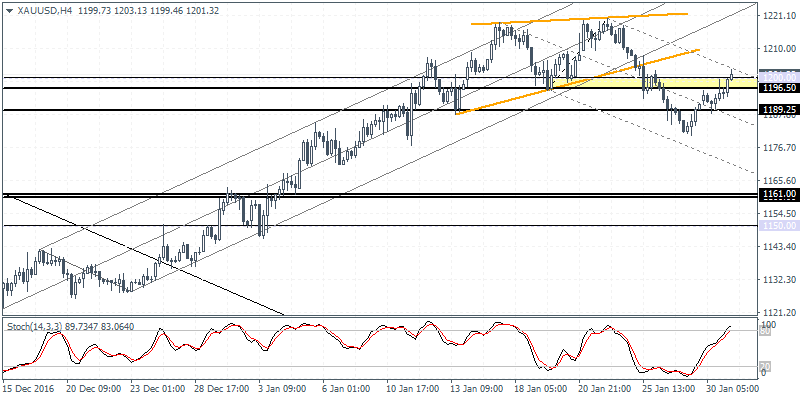

XAUUSD intra-day analysis

XAUUSD (1201.32): Gold prices are back trading at the $1200.00 price handle this morning, and the risks are balanced from the current levels. To the upside, a clean daily breakout above $1200 is required to ascertain further gains in gold prices while to the downside, which is incidentally supported by the bearish divergence in prices indicates the downside correction back to 1161 at the very least. With gold prices trading at the resistance level, the price action over the next day or two will likely determine the short-term trend in gold prices.