Exeria is a Poznan, Poland based startup which offers traders to build robots in a very easy and visual way. In addition, they offer sharing the ideas with the community.

Here are some of their capabilities, as explained by the company:

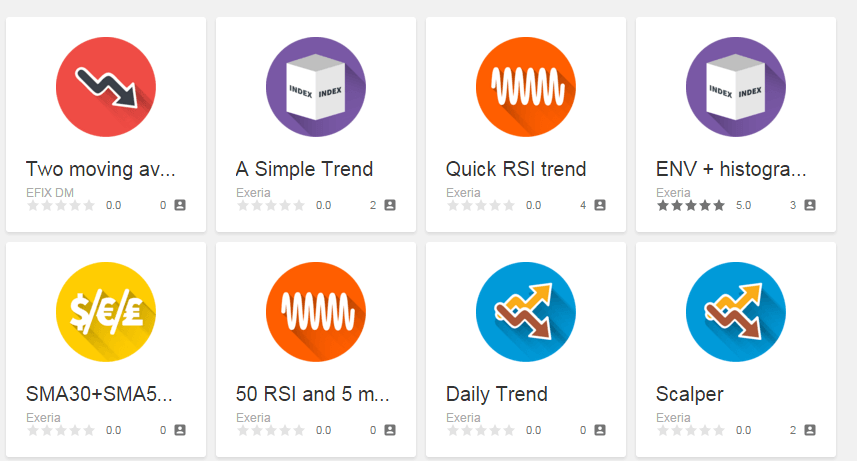

The options are many in Exeria, let’s say that you are a beginner in FOREX and you can’t spend to much time concentrating on all the mechanics that normally go in to learning how to use MT4 EA builder etc. You can get an MT4 account go to our web site and pick the highly ranked strategies install them in the platform it takes less than a minute and start it working. But what if you have more experience and ideas. Then you can combine Exeria with Arena and build your own algorithmic bots in minutes. You don’t need to use code like Ninja Trader, you don’t need to copy and paste, try the bots out, look for bugs, go back make adjustments, copy and paste again etc like in EA builder. We have created a drag and drop system where you actually see the corrections that you make on your Candle Chart, indicators and Equity line as you drag and drop. Once you have perfected your Robot, you either save it on your hard disc or upload it to our cloud, where you are free to make it private, share it with friends, or (in the future) put it up for sale to the world.

And here is more information from the company:

A lot of people who invest are unaware of the possibilities that algorithmic trading can open up to them. Saying that you are old school when it comes to algorithmic trading, is like saying that you would rather take a boat in steerage class than fly first class to France. And this comparison is so valid in the since you will loose an enormous amount of time, and loose valuable opportunities because you are still traveling to your destination and are simply not there yet. Many will use the excuse that there have been mishaps with algorithmic trading and that is safer to stick with what we know. With this mentality, most of us would still be riding horses or walking to destinations because we don’t want to risk being in car accidents.

So, how should one use algorithmic trading? First of all, if you are a reasonable traders you will set up a risk management plan. I am a firm believer that those who enter trades with no risk management plan, really have no plan. In most good algorithmic platforms there is probably an automatic stop loss system built into it. The amount that you can afford to loose should be on the forefront of your thoughts in every trade that you go into and its parameters should be installed into the trade from the get-go. And while you are deciding that, you should decide how much profit you expect after having studied your trade.

Algorithmic bots can set up and study a trade far more clearly than any human on the planet if they are programmed correctly. Alas, therein lies the rub algorithmic bots are only as good as their combined strategist and programmer. This is why there use has been so limited until recently.

In the last five years we have seen a multitude of systems that offer bots, more or less effective at prices that are sometimes to good to be true or quite high but still buy-able, if you only buy one. The truth of the matter is that there is no “one wonder bot” for all occasions, and if there ever is buy the patent because you will become a billionaire. Most bots can’t even be tweak to conform to current market situations because they a black boxes that can’t be open or tweak therefore a stable element in a market that is volatile. How much sense could that make? Therefore, all the companies offering “the one bot does all” are just looking to take your hard earned money. With all of that taken into account, sometimes I can understand why people steer away from bots, however you should never throw the baby out with the bath water.

We have a system that allows you to substantially control your bots while all the time letting them do the job that they were created to, and that is “to find the right signal”. That system is called Exeria, it allows you to pick the robot that is right for your trade, it allows you to even tweak a pre-programmed bot and make it reach the specification that you want through the aid of another programmed called “Arena”. It’s flexibility is enormous,

- set up the time, date, or day of a trade

- hedge one instrument against another

- Build team bots one that go long and the other the go short (but never conflicting each other)

- Keep accurate records of losses and gains

- control numerous robots at a time so that you are well diversified

- Exeria is also a perfect scanner when it is in manual mode

The list of its advantages goes on.

So are you going to do things as you have always done and risk being passed by in the long run, or are you going to join Exeria and risk being a part of the future.

https://www.youtube.com/watch?v=j7V44pj0yWE