Fear and greed are two emotions which can overrule a trader’s rational mind, and by extension, the financial markets. With every data release or piece of financial news, markets will react on both an emotional and rational level. The divergence between the two often causes large intra-day swings in financial markets, and so can represent good trading opportunities.

Here we look at the Bank of England (BoE) Inflation Report of 7 August 2013, which contained forward guidance on interest rates, and its effect on GBP/USD.

Rupert Osborne works on IG’s dealing floor in London. To find out more about CFDs, spread betting and forex visit https://www.ig.com/uk/forex-

When complex information like this is released to the market, it is done all at once, so a large amount of data is available to everyone at the same time. Financial institutions have algorithms which automatically ‘read’ this data and then place trades accordingly, much faster than a person could.

The rational response takes a while to process; paragraphs of text may have to be read and interpreted by a human being for its likely impact. Data tables and forecasts must be analysed and weighed up. In other words, it is the result of consideration of the details, and is a complex and subjective process.

An emotional response is far quicker; a quick scan of the release, by a machine or person, is enough to confirm if it matches what you have been expecting. And if not, which direction has it gone? It is the instant, knee-jerk reaction.

When you know how a market is likely to process news, you gain the opportunity to spot whether you believe there has been an immediate over- or under-reaction, and trade accordingly.

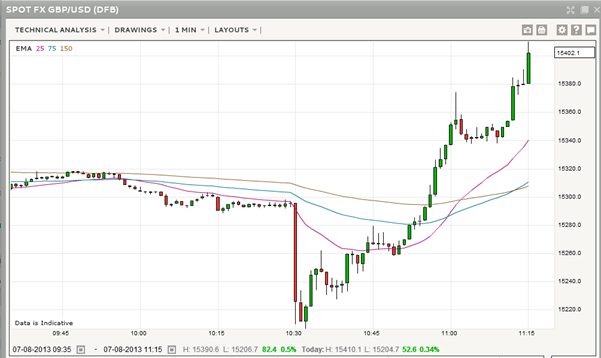

Prior to the BoE’s release that morning, it had been widely trailed in the media that there was going to be a commitment to long-term low interest rates. With one minute to go, GBP/USD was trading just below 1.53.

Here are the first in the stream of headlines that were all released at 10.30am on 7 August:

At first glance it looks like UK interest rates were going to be held at record lows for at least three more years, exactly what many in the market were expecting – a prolonged period of easy policy, which could depress the value of the pound. In the FX market we saw the instant, emotional response – the pound dropped against the US Dollar by almost a whole cent in the first minute after the release, hitting a low around 1.521.

The headlines were of course accompanied by a lot of detailed text and a press conference by the BoE governor, Mark Carney. As the details were digested, it became clear from the market’s reaction that the rational response was the opposite. The strength of recent UK economic data had suggested that the economy was improving. Some felt the BoE’s targets were quite soft, and could easily be met. This implied interest rates might rise much sooner than had been expected.

Within 30 minutes, GBP/USD was back at the same level before the release. Just 45 minutes later it was a cent higher, a swing of 200 pips, and a great opportunity for day trading.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.