- Bitcoin price bounced off the $40,000 mark for a second time this week to trade above $42,000.

- China pumps $18.6 Billion Into Banking System to calm global market fears over Evergrande.

- The $40,000 mark crucial to BTC undoing the recent losses.

Bitcoin price traded below the $40,000 mark for the first time since August 06 yesterday. This happened in the late trading sessions of September 21 with BTC having lost 7.86% from $42,976 at the start of the day to an intra-day low of around $39,599. This marked a 25% decline from the September 07 high of around $52,910.

The crypto Fear and Greed Index shows that the current bearish action is in tandem with the ‘extreme fear’ sentiment that has currently gripped the market. This a complete reversal from over a month ago when the same metric indicated an ‘extreme’ greed market sentiment.

Bitcoin Price Bounces Back From $40,000 As China Calms Evergrande Fears

On September 22, BTC/USD price bounced back from retesting the $40,000 mark after making a comeback from areas around it the day before.

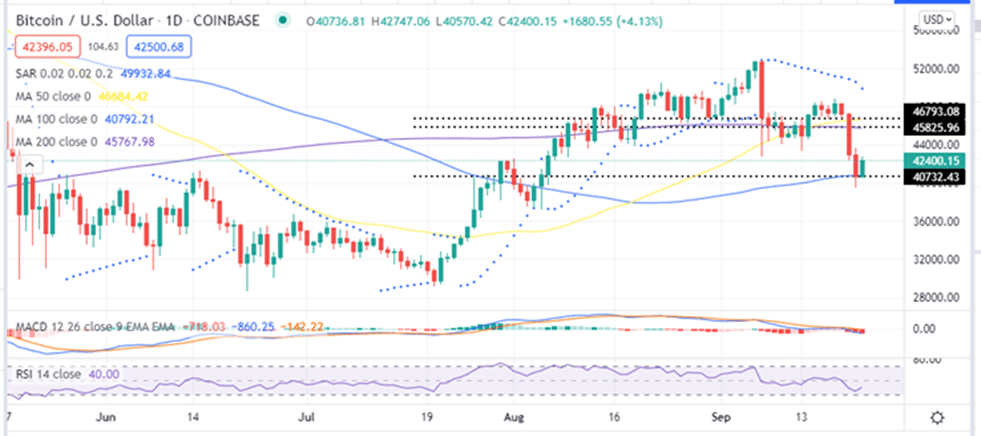

At the time of writing, Bitcoin is trading around $42,400 with bulls determined to hold on the 100-day Simple Moving Average (SMA) at $40,732 as seen on the daily chart.

The mood remains positive among Bitcoin investors but there are still mixed messages in the macro environment with concerns particularly focused on China.

One of the largest real estate companies in China, Evergrande, is still feared to default as much as $300 billion dollars in debt. As a result, China’s central bank, the People’s Bank of China (PBoC), Injected $18.6 Billion (120 billion yuan) Into Banking System to calm the fears around the debt crisis at China Evergrande Group that has roiled global markets.

This has soothed anxious investors, with the potential collapse of the Evergrande being touted as a state-controlled crisis than a full-blown financial crisis that could resonate in all global markets.

The mood was also buoyant after the Chinese real-estate giant’s onshore property unit announced that it would repay its interest due on September 23 on its local bonds.

- Are you new to cryptocurrency trading? Read guide on how to buy cryptocurrency to get started.

The $40,000 Support Level Crucial For Bitcoin Price

At the time of writing, BTC/USD price is trading above the $42,000 after two straight bearish sessions over the last couple of days.

After dropping 14% from areas around $47,37 on Monday to close the day around $40,890 on Tuesday, Bitcoin’s sell-off was halted at the 100-day SMA around $40,732.

Bounding off this support wall, BTC has risen to the current price around $42,400. Bitcoin bulls are striving to defend this level by ensuring that the price remains above this level.

A closure above the immediate support provided by the 100-day SMA at $40,732 will bolster bulls to push the price of the Big crypto to tag the $44,000 psychological level. A move above this level will see BTC rise to tag the 200-day SMA around $45,825.

However, a clear bullish breakout will be achieved once Bitcoin overcomes the 200-day SMA and the 50-day SMA around $46,793 to which would easily bring the September 07 high above $52,000 into the picture.

The upward movement of the Relative Strength Index (RSI) away from the oversold region shows that the bulls are currently in control of BTC.

BTC/USD Daily Chart

On the flipside, the $40,000 mark is very crucial to ensuring that Bitcoin does not continue bleeding under the hands of the bears.

Analysts believe that the flagship cryptocurrency is in ‘good shape’ as long as BTC price holds above $40K.

Mike Novogratz, Galaxy Digital CEO, is a veteran Bitcoin bull who says that he’s not “nervous” unless Bitcoin fails to hold above $40,000. In an interview with CNBC on September 21, the infamously bullish investor calmed fears about the latest sell-off across the crypto market. Novogratz argued that the recent decline was a healthy corrective moved for a market that has spend the better part of this year in a bullish mode. He added:

“I think the market got itself a little too long — the China news scared people…. very important levels to watch” are $40,000 for Bitcoin and $2,800 for Ethereum’s coin, Ether (ETH), … As long as those (these levels) hold, I think the market’s in good shape.”

Apart from Novogratz, popular analyst William Clemente III is also eyeing the $40,000 level as a crucial support zone for the BTC price. Clemente recently asserted that BTC is unlikely to tank below $39,000 given its liquid supply floor and “real-time scarcity” associated with the pioneer cryptocurrency.

- If you wish to trade Bitcoin, this list of top crypto brokers could be helpful.

Looking Over The Fence

Despite the positive sentiments around BTC, things could go awry if Bitcoin bulls fail to hold above the 100-day SMA around $40,732. A closure below this level could see BTC pull back towards the $40,000 mark.

A clear bearish breakout will be seen if Bitcoin price tanks below the crucial $40,000 mark that would make the journey downward less resistant. This could see BTC seek support around the $38,200 level to tank further towards the July 20 low below $30,000.

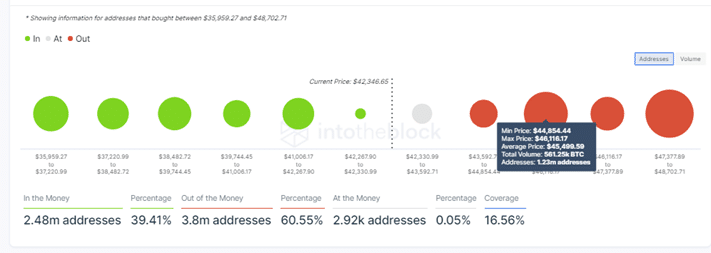

This outlook is accentuated by the IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model which shows that Bitcoin faces still competition upward as compared to downwards. The $45,825 zone embraced by the 200-day SMA is a major resistance found within the $44,854 and $46,116 price range. Approximately 1.23 million addresses previously bought roughly 561,250 BTC within this price range.

Bitcoin IOMAP Chart

As such, Bitcoin price prediction remains bearish given these parameters. The movement of the MACD below the zero line in the negative region suggests that Bitcoin market momentum is negative.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk