Federal Reserve’s James Bullard has been reported saying that they will look for leadership from the Fed’s chair, Jerome Powell, about when to start a QE tapering discussion, but said it was too early to start in the midst of the pandemic.

Bullard’s comments

If “we play our cards right” Fed might be able to move inflation above target during post-pandemic “boom”.

Asset prices “not way out of bounds” when compared to pre-pandemic levels of a year ago.

GameStop a “spectacular” example of speculation, but not an issue for monetary policy.

“Not seeing” financial stability risks rising from Fed policy; Wall Street hopeful for recovery, corporate profitability.

Recovery “already looks strong” without further fiscal spending.

Market implications

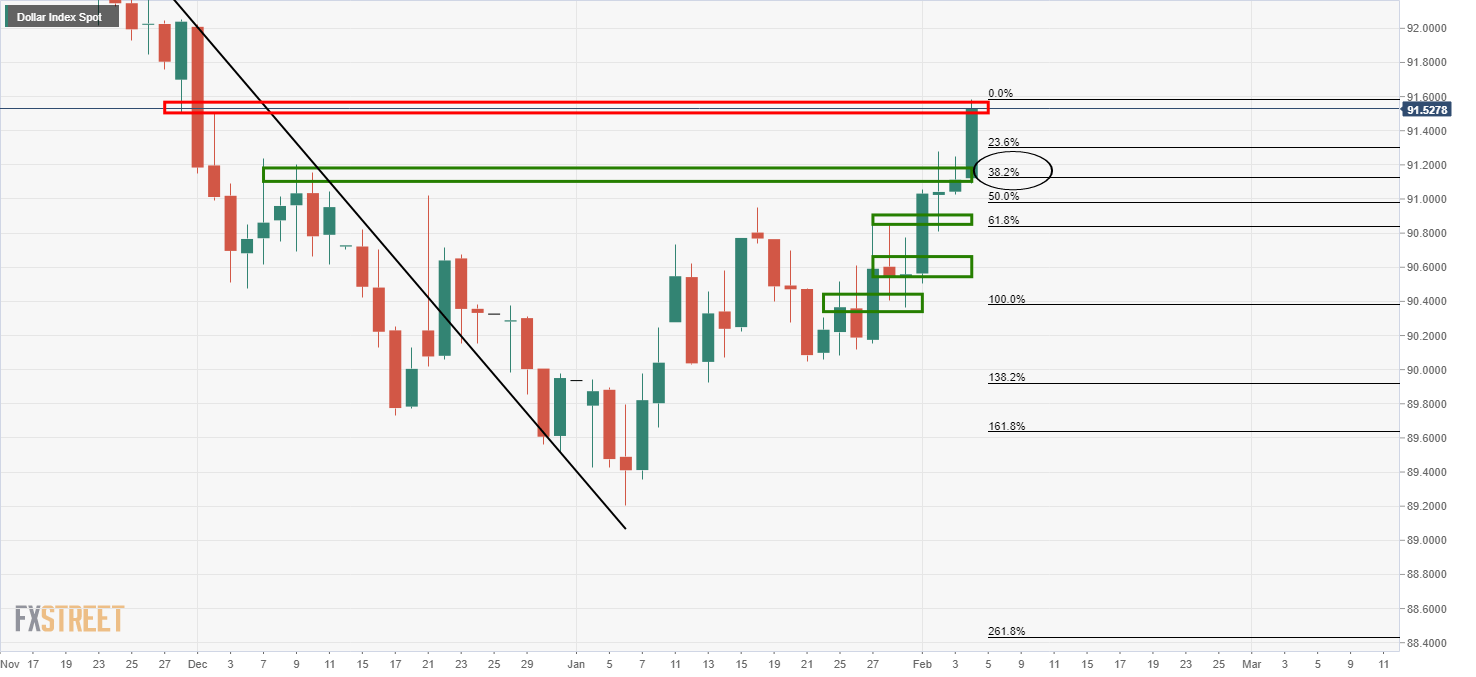

The tapering theme has given the greenback a boost this year.

It has been on fire for the Month so far, most recently bursting through resistance within a consecutive daily bid of higher closes, denying the market of a significant discount.

The confidence in the US economic outlook and the possibility that Friday’s jobs report might be stronger than expected is fuelling the bid.

The US dollar index DXY rose 0.48% in New York morning trading to 91.583, its highest level in two months and up 1.7% for the year.