There has been some confusion in the markets as to what the Fed has signified by the removal of “The stance of monetary policy remains accommodative,” from today’s statement – and not surprisingly so when the initial reaction in the greenback was a spike lower when one might expect that should the Fed reining its attempts to expand the overall money supply to boost the economy, it means that they are bullish o their outlook for growth – and that is evident in the recent projections for GDP as follows:

- 2018 – 3.1% vs 2.8% prior

- 2019 – 2.5% vs 2.4% prior

- 2020 – 2.0% vs 2.0% prior

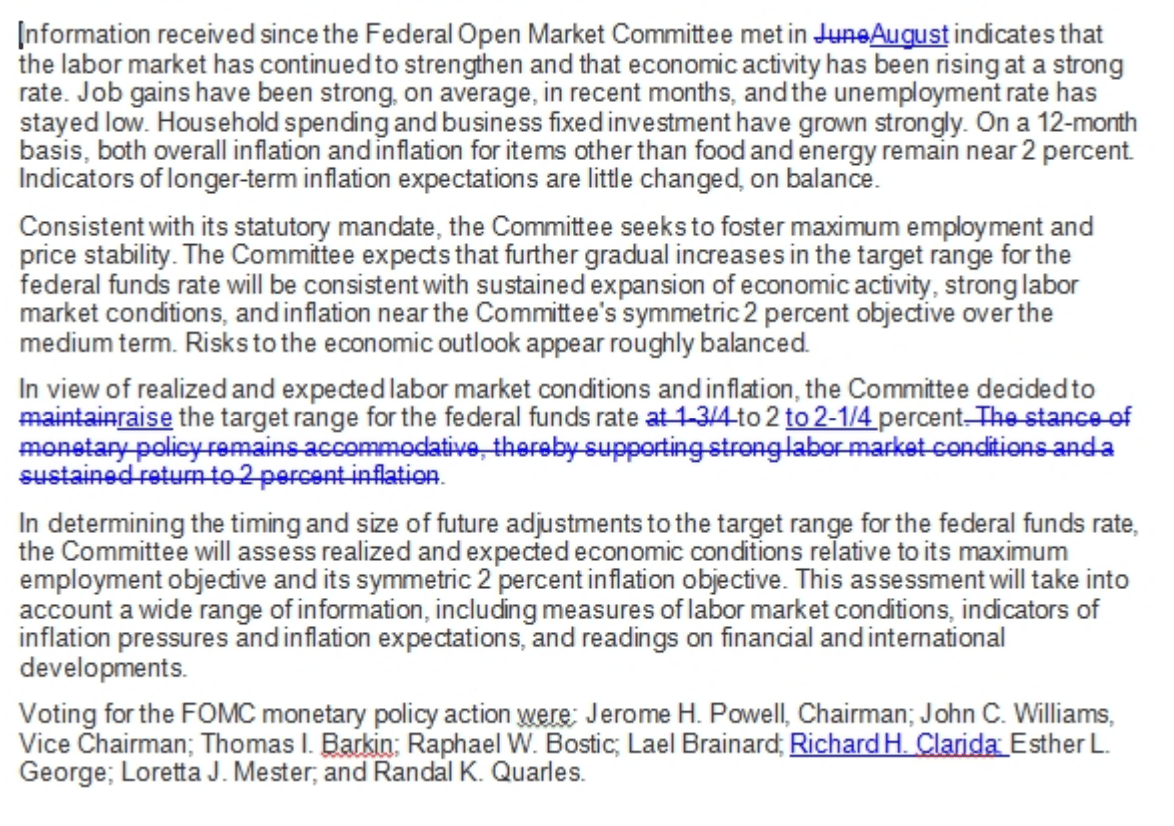

Analysts at TD Securities offered a side-by-side comparison of the FOMC statements – take a look:

It all looks rather hawkish at first glance and indeed the economic projections are bullish, here are the unemployment rate upticks:

Unemployment rate:

- 2018 – 3.7% vs 3.6% prior

- 2019 – 3.5% vs 3.5% prior

- 2020 – 3.5% vs 3.5% prior

However, here are the PCE inflation projections, not so hawkish:

- 2018 – 2.1% vs 2.1% prior

- 2019 – 2.0% vs 2.1% prior

- 2020 – 2.1% vs 2.1% prior

Nevertheless, the median projections are for one further rate hike this year and an additional three hikes next year and that is hawkish where otherwise, the doves out there in the market might have been expecting perhaps just two more hikes in 2019. However, the 2021 dot indicates an end to the rate hike cycle with some Fed officials pencilling in cuts – and if the likes of the ECB (growth depending), BoC, BoE (Brexit depending) are playing catch up – then that could be the motivation for the initial spike lower in the greenback. However, it now seems that the market wants to be long of dollars figuring that the US is streaks ahead in its growth and rate hike cycle – You don’t get a better yield elsewhere.