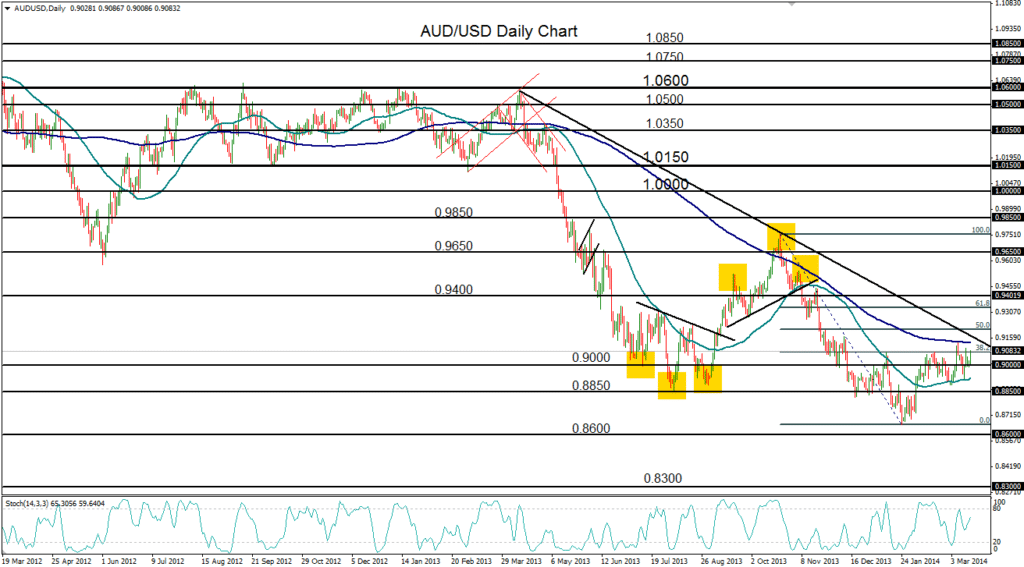

March 17, 2014 – AUD/USD (daily chart) has continued to trade within a moderate range between its two key moving averages – the 50-day and 200-day – for more than a month. This consolidation phase occurs within a strong bearish trend that extends back to the April 2013 high near 1.0600, and which continues to remain intact. Within this bearish trend, the currency pair has rebounded from its three-and-a-half-year low of 0.8659 that was hit in January, but has been unable as of yet to follow-through significantly on this rebound.

The 200-day moving average to the upside is currently serving as strong resistance, and has recently halted the pair’s further rise. Also directly to the upside resides a major downtrend resistance line that connects the noted April high near 1.0600 with the October high at 0.9757. With this confluence of strong resistance directly above current price action, AUD/USD could well be constrained in its attempts to advance. If the pair continues to respect resistance with a move back to the downside below the noted 50-day moving average support, major targeted support levels further to the downside continue to reside around 0.8850 and then 0.8600.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.