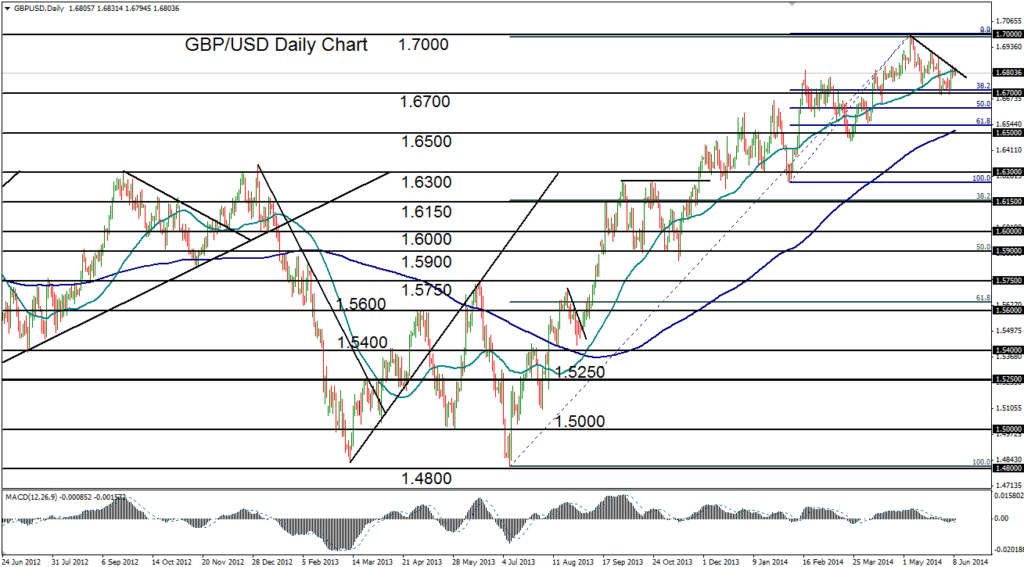

June 6, 2014 – GBP/USD (daily chart) within the past week has attempted a rebound and recovery from its key 1.6700 support level up towards its long-term highs. In the process, the currency pair has risen once again back up to its 50-day moving average. This exhibits the continuing magnitude of strength that the pound has generally maintained against the U.S. dollar for the past year, in contrast to other major currencies.

For over a month, GBP/USD has declined in a measured pullback move from its four-year high of 1.6995 that was reached in early May. This pullback has formed a month-long descending trend line that has not yet been breached to the upside. Price action is currently in consolidation at the important juncture of this short-term trend line and the 50-day moving average.

With any significant breakout above this resistance juncture, a recovery from the current pullback should be in order. The upside target in this event would once again reside at the 1.7000 level for a potential resumption of the current uptrend. To the downside, for any potential breakdown and extension of the pullback below the noted 1.6700 support level, which also happens to be a key 38.2% Fibonacci retracement level, a further downside support target resides around the 1.6500 level and the 200-day moving average.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.