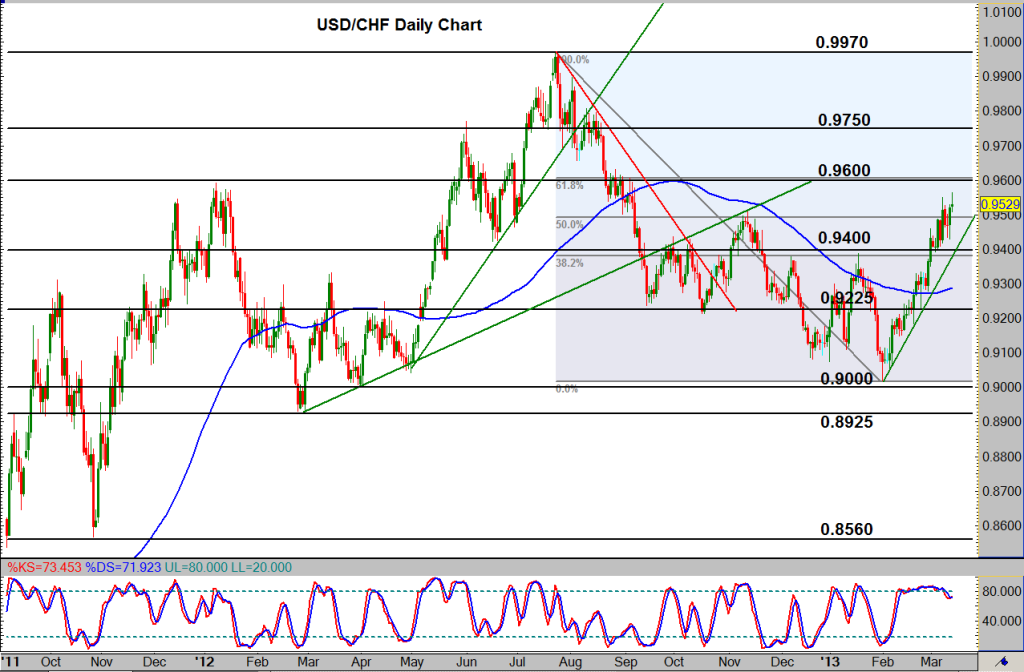

USD/CHF (daily chart) as of March 14, 2013 has advanced the steep uptrend that began in February by establishing a high at 0.9565 in early trading this morning, reaching a new half-year high. The bullish trend began more than a month ago from the low around the key 0.9000 support area, and has followed a steeply-angled trend line to the upside without any major bearish retracements thus far.

Price has currently approached a key resistance area around 0.9600, which also resides near a 61.8% Fibonacci retracement of the downtrend from the July 2012 high at 0.9970 to the early February low at 0.9020. With the U.S. dollar displaying substantial strength in recent weeks, this resistance target to the upside should not be hard to reach on a short-term horizon. In the event of a breakout above the 0.9600 level, key upside targets include 0.9750 and then 0.9970, the July 2012 long-term high. To the downside, major support in the event of a deeper pullback within the current bullish trend resides around 0.9400.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.