- FOMC offered a dovish bias and sunk the dollar and US yields.

- Aussie could come under pressure form a scheduled speech from RBA’s Lowe today.

Forex today was centred around the Federal Open Market Committee meeting and the dovish outcome that was expected. The dollar initially sold off but bounced back just as stocks peaked following Powell’s presser. All in all, the steep and sustained fall in US yields should keep the greenback’s advances capped, but for Asian currencies, trade uncertainties and an easing bias at their own major central banks will remain an anchor – Despite weak USD sentiment, RBA governor Lowe’s speech could be a weight on the Aussie as he will likely provide greater clarity around the timing of the next cut to the cash rate.

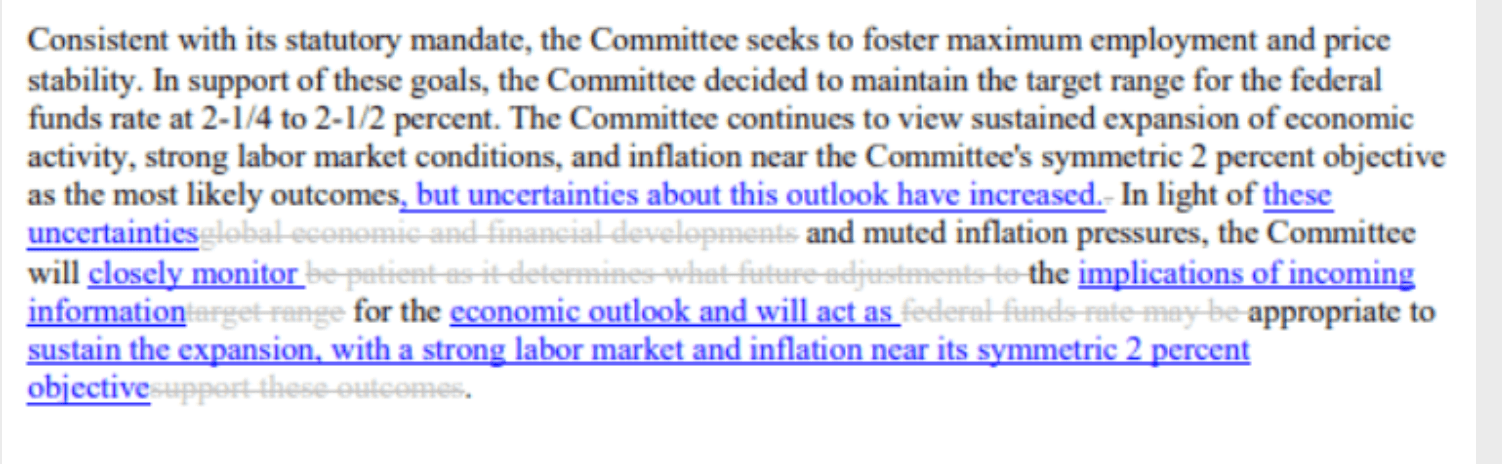

Meanwhile, the Federal Reserve has left rates and policy on hold, as expected, but has signalled to the market an easing bias by dropping language saying it would be ‘patient’ on future policy adjustments and that they are closely monitoring and will act as appropriate. The balance sheet roll off will proceed as planned. The 10 year US yield was falling to 2.038% from a prior range of between 2.0530% and 2.0990%, well down from the 2019 high of 2.80%. 2yr yields were osting an even larger fall from 1.88% to 1.74%. There is now a 25bp of easing priced in for the July meeting, with a total of four cuts priced by mid-2020.

-

CME FedWatch Tool shows 89% chance of a 25 bps rate cut in July

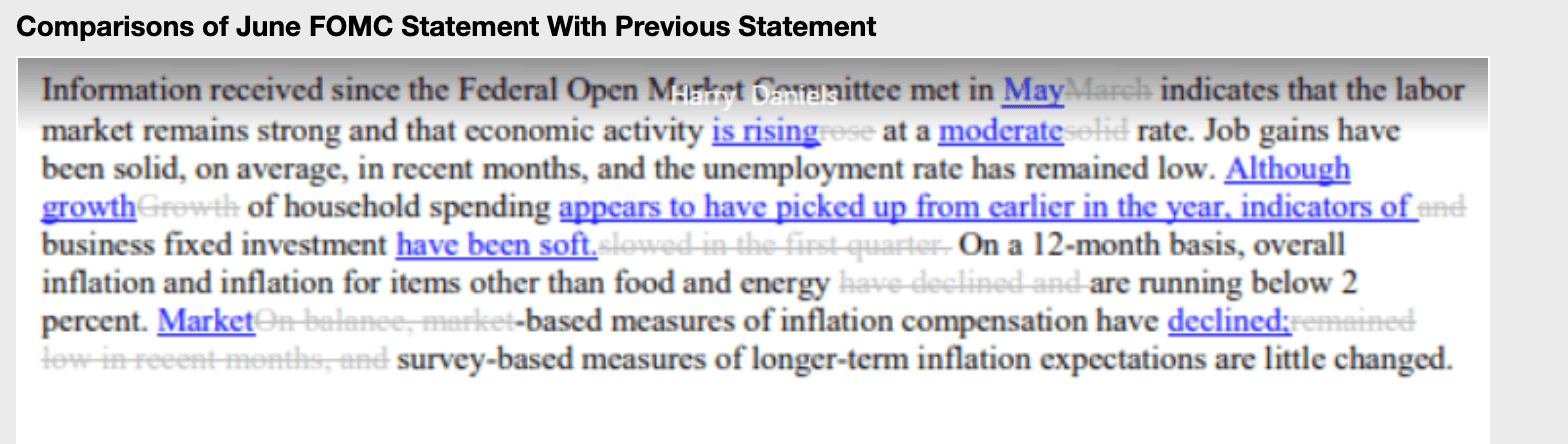

The FOMC Statement comparisons:

The FOMC meeting main takeaways:

- Interest rate on excess reserves unchanged at 2.35%.

- Benchmark interest rate unchanged; target range stands at 2.25-2.50%.

- Drops language saying it would be ‘patient’ on future policy adjustments.

- Uncertainties have increased regarding outlook for sustained economic expansion.

- 9:1 policy vote, Fed’s Bullard dissented because he wanted a rate cut

- To act as appropriate to sustain econ. expansion with a strong labour market, inflation near target

- Economic activity is rising at a moderate rate

- Household spending appears to have picked up but business fixed investment has been soft

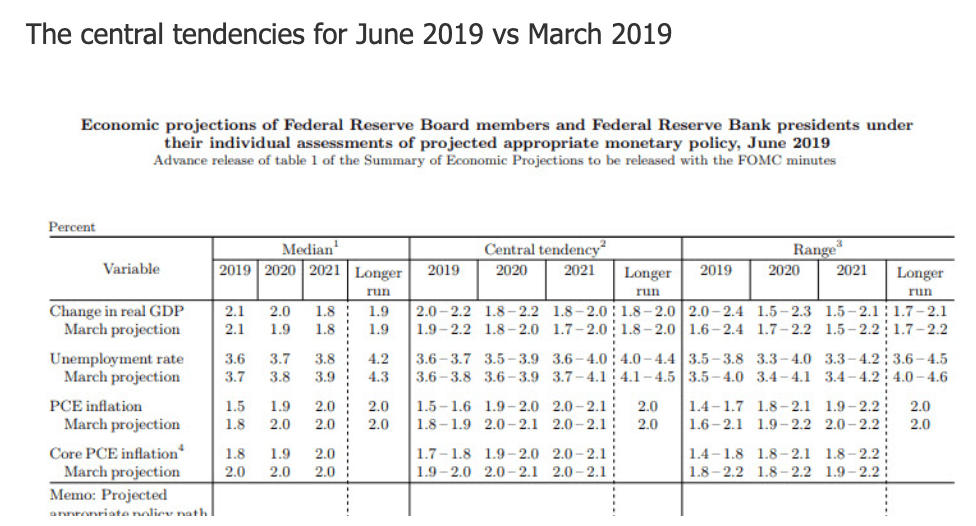

The Dot Plot

“The ‘dot plot’ shows a median steady policy this year but that obscures a big dovish tail, with 8 among 17 projecting cuts this year – almost all (7) project 2 cuts this year. Chair Powell also noted in his introductory remarks that even those who projected a flat Fed Funds profile conceded that the case for a cut had strengthened. The median for 2020 now shows a 25bp cut, a 50bp turnaround from the hike that was projected by the median back in March. The long run rate was trimmed 25bp,” analysts at Westpac explained.

Since then…

In early Asian markets, the Kiwi was a focus with the New Zealand GDP data which was a 0.1% beat on the year, sending the Kiwi 20 pips higher on the knee jerk.

- New Zealand GDP: Quarterly rise 0.6% (2.5% annual/a beat kiwi rallies 20 pips)

Currency action

Analysts at Westpac gave a summary of the price action overnight before the New Zealand GDP data (Kiwi spiked 20 pips)

- The US dollar was volatile, falling in response to the FOMC statement but trimming its losses to be only a little softer against most major currencies.

- EUR/USD rose about 30 pips to 1.1254 then steadied at 1.1230.

- GBP/USD rallied substantially before the FOMC then consolidated around 1.2640, up 0.7% on the day. UK May inflation data was on the firm side. Though headline CPI was in line at 2.0%y/y, core CPI held firmer than expected at 1.7%y/y (est. 1.6%y/y, prior 1.8%y/y).

- USD/JPY fell from 108.35 to 107.90 and then steadied around 108.10.

- AUD/USD initially jumped from 0.6870 to 0.6909 in response to the FOMC but then retraced to 0.6880.

- NZD/USD similarly spiked from 0.6530 to 0.6563 before retracing to 0.6535.

- AUD/NZD wasn’t too ruffled, ranging sideways between 1.0515 and 1.0535.

Key notes from Wall Street:

Wall Street continues upside correction on dovish FOMC

Key events ahead:

- RBA governor Lowe speaks in Adelaide titled “The Labour Market and Spare Capacity” from 12:35pm Syd/10:35am Sing/HK.

- The Bank of Japan meets – The decision has no fixed time but is most likely within an hour of 12:30pm Syd/11:30am Tokyo.