Forex today was on rocky grounds prior to the European markets opening after sparks of trade war angst were lit up again by headlines in early Asia that the US planned to impose 25% tariffs on imported vehicles. Risk sentiment was poor and the usual risk-off asset classes were better bid. However, markets tumbled in Europe and pre-markets went offered too on the headlines that Trump had sent a letter to the North Korean leader, Kim Jong Un, cancelling the meeting.

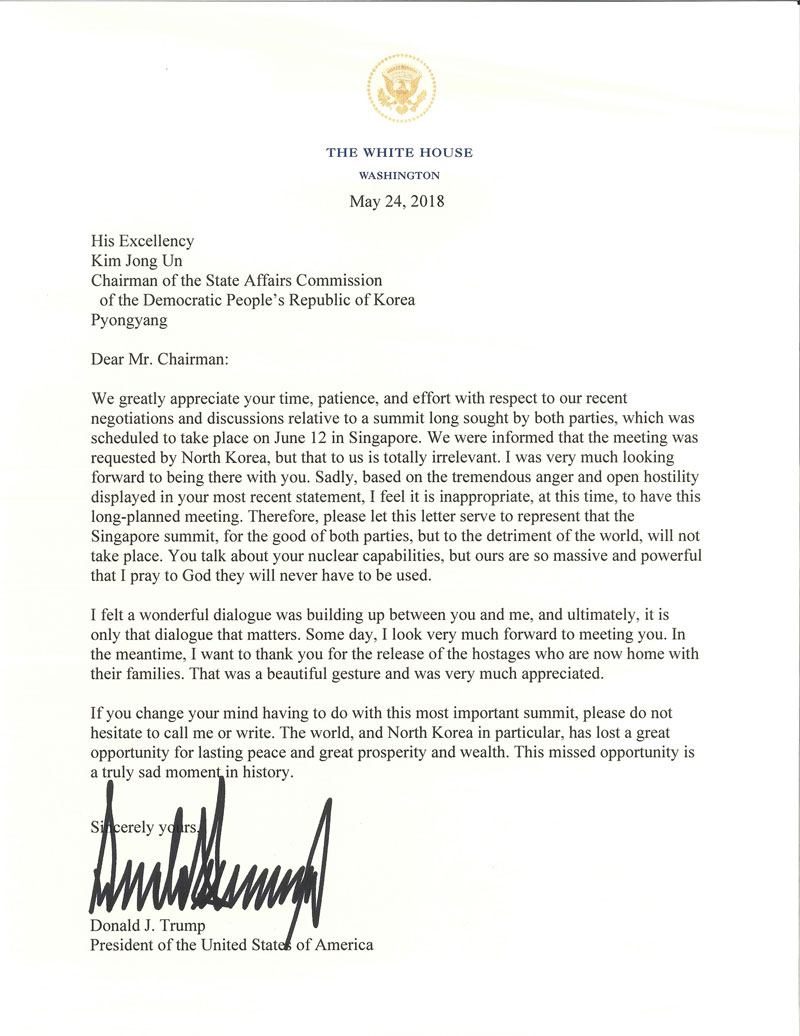

Trump’s letter as follows, (this letter was written entirely in his own words, a senior administration official said):

Meanwhile, the UK had come with a more positive tone with respect to the retail sales data that offered some short-term support to sterling at least. GBP/USD ran up to the 100-hr SMA on the release of better than expected UK retail sales data for April, (+1.6% M/M versus +0.5% expected).

As for the greenback, DXY traded within a range of 93.6080-93.9780. The US 10yr treasury yield dropped from 3.01% to 2.95 %, (another two week low), before settling down at 2.97%. Following yesterday’s FOMC minutes which the two-year Treasury note yields are usually sensitive to, they were down 8 basis points over the last two sessions to 2.51%. (Fed fund futures yields fell another 1-2bp while June still remains on the table but following the FOMC minutes yesterday).

As for the euro, it opened around 1.1720 in NY and ranged between 1.1710/55 for the session, but EUR/JPY, (below 127.30), hampered any bullish attempts on the NK/US headlines. A breakdown of the US yields weighed on the greenback and helped the single currency to close 1.1722, despite a heavy feel to the session. The pair trades heavy on the basis of political uncertainty in Europe while the economy is not on par to that of the US recovery. Sterling was better on the NY handover on the back of the retail sales beat. The pair was ending the NY session at 1.3383 within a range of between 1.3422-1.3351. The cross was pressured in Europen trade on the retail sales and general downbeat risk sentiment. 0.8738 was traded before a bounce back to 0.8771 in early NY. The pair drifted lower from there and closed at 0.8757.

USD/JPY was heavy on the back of Trump considering tariffs on auto imports and traded offered between 109.75-109.10 in London.108.96 traded on the back of the Trump letter but USD/JPY closed at 109.19 and below the key 109.27 Kijun. As for the Aussie, metals were firmer, with copper scoring a bid to 3.1054 and this helped AUD/USD continue its correction to 0.7582 the high from European lows of 0.7551. However, WTI was down to $70.50 and the commodity complex and EMFX are on thin ice.

Key notes from the US session

- Funda-FX wrap: Trump’s letter to Kim cancelling the what would have been historic summit

- Wall Street stocks virtually unchanged after panic over Trump-Kim summit cancellation