Our free forex signals service today looks at the CAD/JPY and we have the entry, stop and take profits levels for you.

The Canadian employment data released on Friday that missed expectations of the market participants. Although the unemployment rate fell to 7.5% from 7.8% in June, it was expected to come at 7.4%. This led to a fall in the Canadian Dollar across the board.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

On Monday, the Canadian Dollar continued the Friday’s trend during the Asian session. However, it found some support as the European markets opened. Still, there are several factors that can hamper further rise in the Canadian Dollar. One of the major factors is crude oil prices that fell 2% on Monday amid rising fear of coronavirus and potentially declining demand.

On the other hand, the Japanese Yen has also shown some traction on the day as the risk sentiment remains sour. Most of the JPY pairs follow the USD/JPY pair. In the wake of USD/JPY’s fall today, the CAD/JPY may also keep falling.

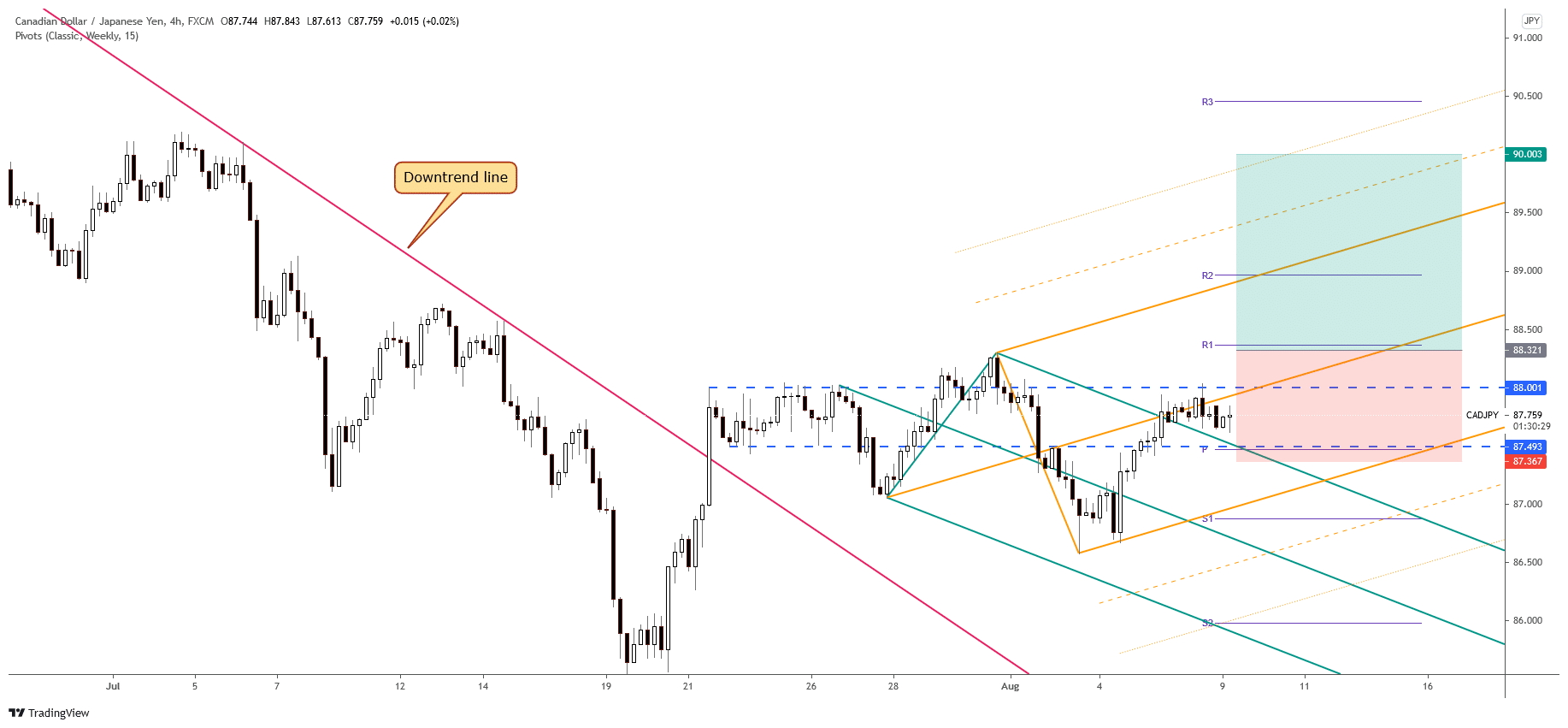

However, any rise of CAD/JPY pair beyond the 88.00 mark will trigger strong buying and shed off bearish momentum.

CAD/JPY free forex signals

Instrument: CAD/JPY

Order: BUY STOP

Entry price: 88.321

Stop Loss: 87.367

TP1: 90.003

Recommended Risk: 1%

Risk / Reward Ratio: 1:1.76

Signal validity period: Good until cancelled

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.