Our free forex signals service today looks at the EUR/GBP and we have the entry, stop and take profits levels for you.

During the second half of this year, we anticipate the UK economy to continue to recover. The recovery will also be boosted because businesses are getting used to new trade links between the EU and the UK.

Due to vaccines, the link between hospitalizations and cases has been significantly weakened. So, despite the Eurozone’s challenges, we continue to expect the UK economy to do well this year.

In response to signs of rising inflation, the Bank of England (BoE) slightly widened its scope for tightening monetary policy at its August meeting.

The Bank of England also announced that it would slow down bond purchases later this year (the bonds are due to expire at the end of the year), indicating that quantitative easing cannot continue.

Ultimately, the Bank of England is more likely than the European Central Bank to tighten monetary policy first.

–Are you interested to learn more about forex signals? Check our detailed guide-

A fall to 0.85 was expected for EUR/GBP. However, in light of the more optimistic outlook for the UK economy than for the Eurozone, we continue to expect EUR/GBP to trade lower in the coming months. Additionally, we expect tighter restrictions from the Fed and the BOE to support sterling.

EUR/GBP free forex signals

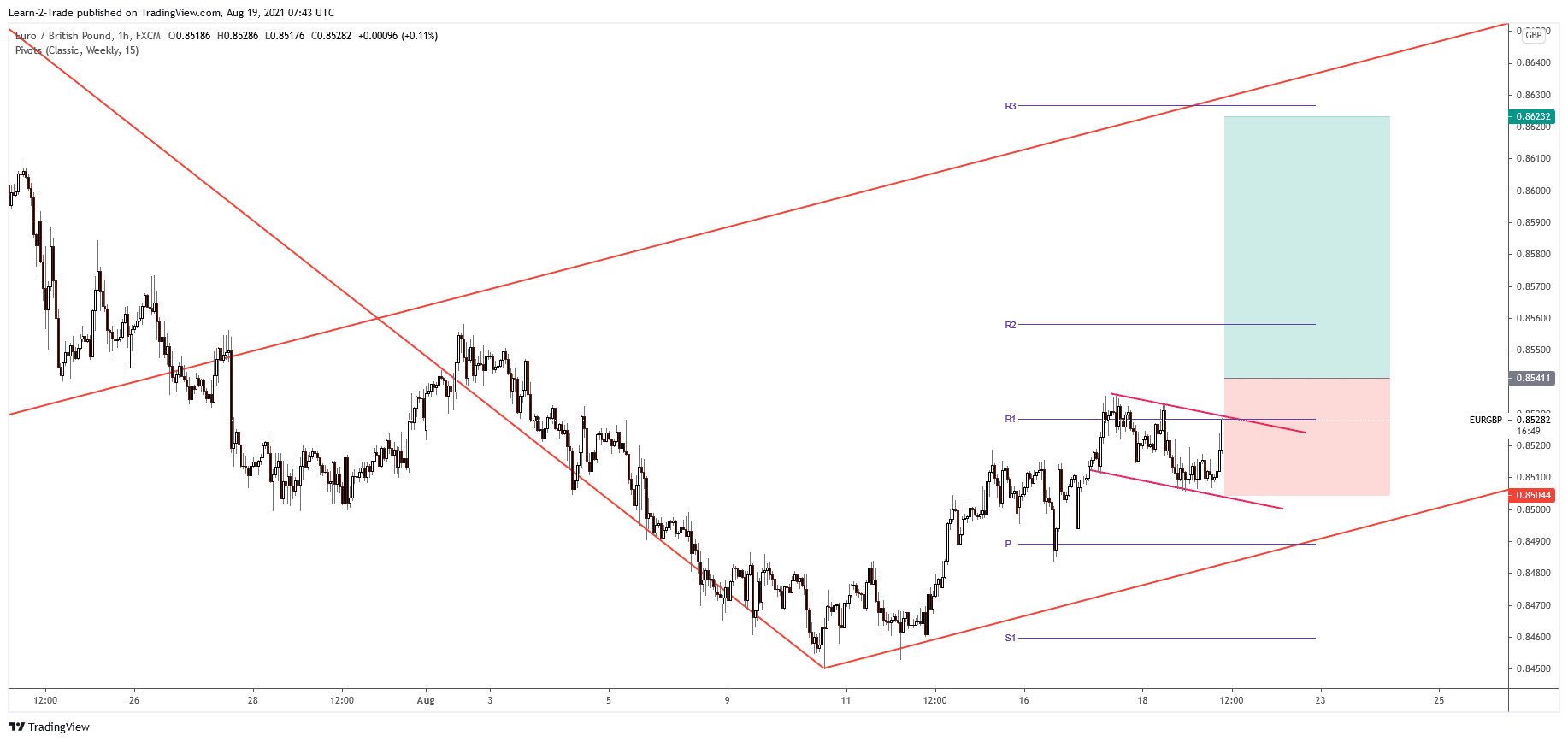

Instrument: EUR/GBP

Order Type: BUY STOP

Entry price: 0.8541

Stop Loss: 0.8504

TP1: 0.8623

Our Risk Setting: 1%

Risk / Reward Ratio: 1:2.24

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.