Today’s free forex signals service is a buy on the EUR/NZD as we expect the market to observe Euro’s upside correction while NZD is still on the downfall.

The EUR/NZD pair sees an upside breakout as the Euro remains calm and quiet after a brief fall in the Asian session. However, the New Zealand dollar remains on the backfoot, continues to fall across the board. The EUR/NZD price broke the 100-period SMA on the 4-hour chart. But the price seems not to find acceptance above it.

The Euro can stay under pressure amid German elections. Olaf Scholz remains a strong contender against Angela Merkel for the position of Federal Chancellor. The voting uncertainty may continue to weigh on the Euro.

Evergrande’s creditors owe around $300 billion. The rescue effort has ground to a halt. Because of uncertainty about how the impact on other construction companies and suppliers will be, there is a dark cloud hanging over markets worldwide. Increasing concerns about global growth are making the dollar a safer asset. The global economic slowdown and rapid expansion of the delta variant continue to worry investors.

New Zealand dollar is a highly risk-sensitive asset, observes a bearish pressure on the day amid broader risk-off mood stemming from the Evergrande and Delta variant spread. Hence, the EUR/NZD pair seeks advantage of a weak NZD rather than a strong Euro.

-Are you looking for the best CFD broker? Check our detailed guide-

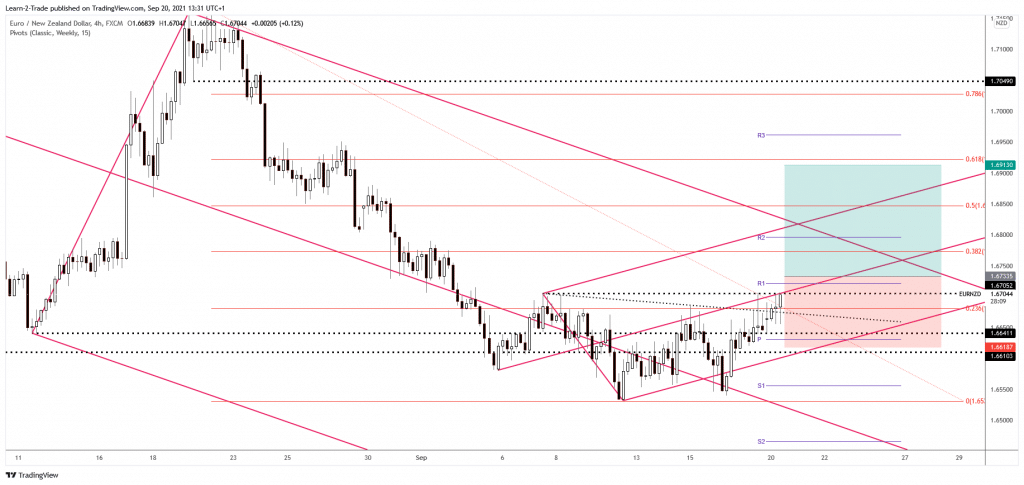

Free forex signals – Buy EUR/NZD at 1.6733

Instrument: EUR/NZD

Order Type: BUY STOP

Entry price: 1.6733

Stop Loss: 1.6618

TP1: 1.6913

Our Risk Setting: 1%

Risk / Reward Ratio: 1:1.56

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.