Our free forex signals service today looks at the EUR/USD and we have the entry, stop and take profits levels for you.

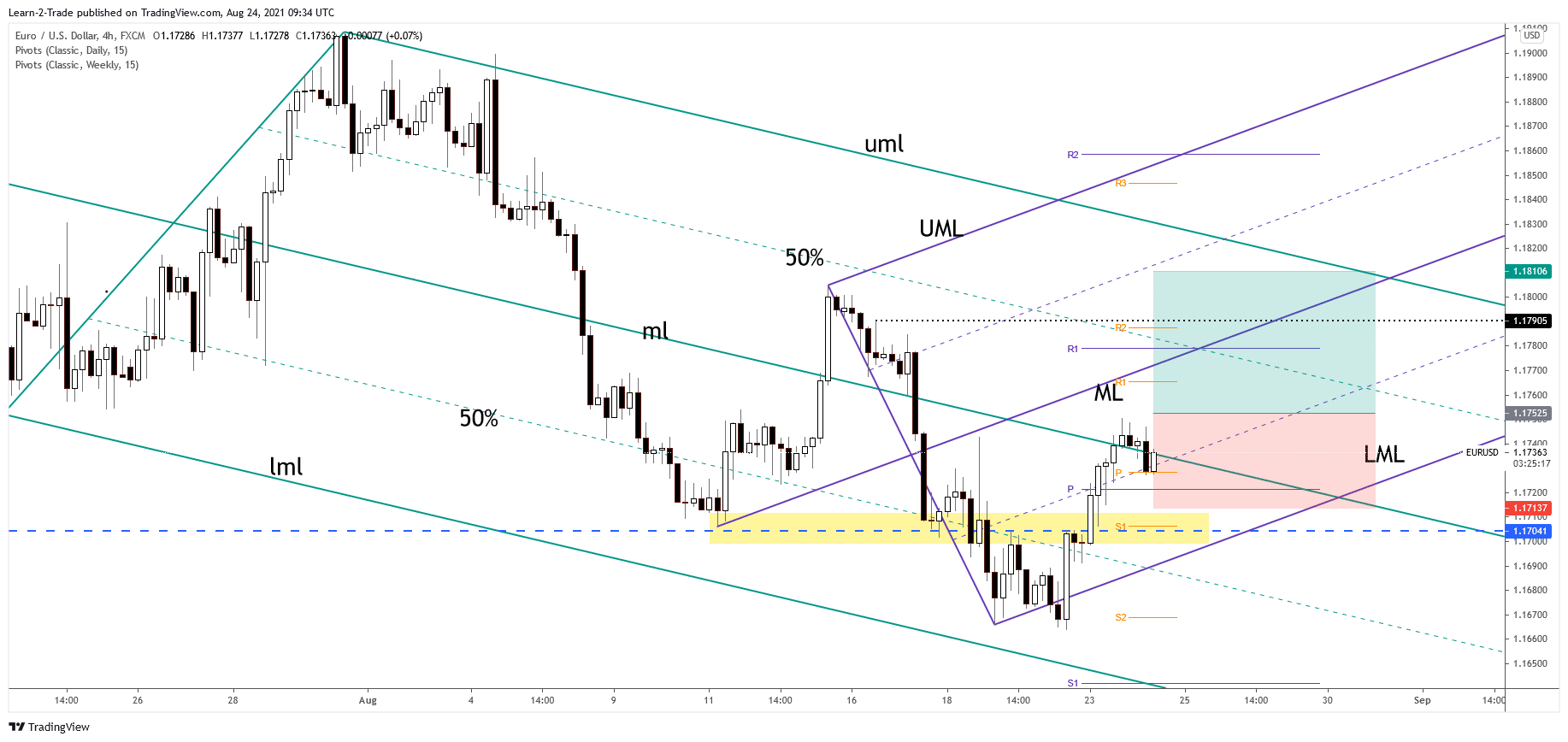

On Tuesday, the single currency was under some selling pressure and pushed back to the 1.1730 area.

The EUR/USD pair is now returning to the 1.1730 area after two consecutive days of gains, including a rebound from November lows around 1.1660 last week.

–Are you interested to learn more about forex signals? Check our detailed guide-

As the dollar appreciated on Tuesday, the price dynamics of the pair were affected amid a lack of direction in US yields and widespread consolidation in global markets ahead of the Jackson Hole Symposium.

The final data on Germany’s GDP revealed an annualized growth rate of 9.4%, over the projected growth rate of 1.6%

New home sales for July and the Richmond Fed Index have to publish across the data front.

A rather moderate obstacle, currently located in the middle of the 1.1700 mark, appears to have hindered the EUR/USD price recovery. Recently, the pair has declined after a rejection of the 1.1880 / 1.1900 range and the strong dollar, fueled by speculation that interest rates will rise.

Although key fundamentals are showing promise in the euro area and morale is consistently high, the ECB’s cautious stance (as of its last meeting) is expected to remain under pressure.

EUR/USD free forex signals

Instrument: EUR/USD

Order Type: BUY STOP

Entry price: 1.1752

Stop Loss: 1.1713

TP1: 1.1810

Our Risk Setting: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.