Our free forex signals service today looks at the GBP/NZD and we have the entry, stop and take profits levels for you.

The GBP/NZD pair has reached a support zone, so a temporary rebound is favoured. Still, we need to wait for fresh trading opportunities and for confirmation before taking action. The price will likely move sideways in the short term as it tries to accumulate bullish energy after its massive drop.

–Are you interested to learn more about day trading brokers? Check our detailed guide –

Today, the Monetary Policy Report Hearings could bring high volatility on the British Pound. GBP lost significant ground versus its rivals after the BRC Retail Sales Monitor increased by only 1.5% compared to 3.2% expected and after 4.7% growth in the previous reporting period. In addition, the Halifax HPI rose by only 0.7% versus the 1.1% growth expected.

The New Zealand GDT Price Index increased by 0.4% compared to 0.3% growth in the last reporting period.

Later today (11:45pm BST), the New Zealand Manufacturing Sales data could bring more market-moving action on the GBP/NZD pair.

How NZD is hurt by latest lockdown

ASB chief economist Nick Tuffley commenting on the latest lockdown in New Zealand and its expected economic impact said: “We are still expecting a fairly decent whack to GDP over the quarter. We did lock down a fair chunk of the country for a good period of time.”

In 2020 GDP dropped 11% in Q2 because of the lockdowns then, but rebounded strongly by a record 14%.

Something similar will likely take place this time round following the discovery of the Delta variant in Auckland three weeks ago – but the fall in economic activity is expected to be less drastic because of more resilience in the economy.

Tuffley says this time the country is moving much more quickly through the alert levels, which got from the highest at level 4 down to 1. Capital city Auckland today went into level 2.

He reckons at level 4 the country can maintain 71% of normal activity. Upon moving to a split level 4-level 3 scenario activity rises to 83% and 88% when in split level 4 and level 2.

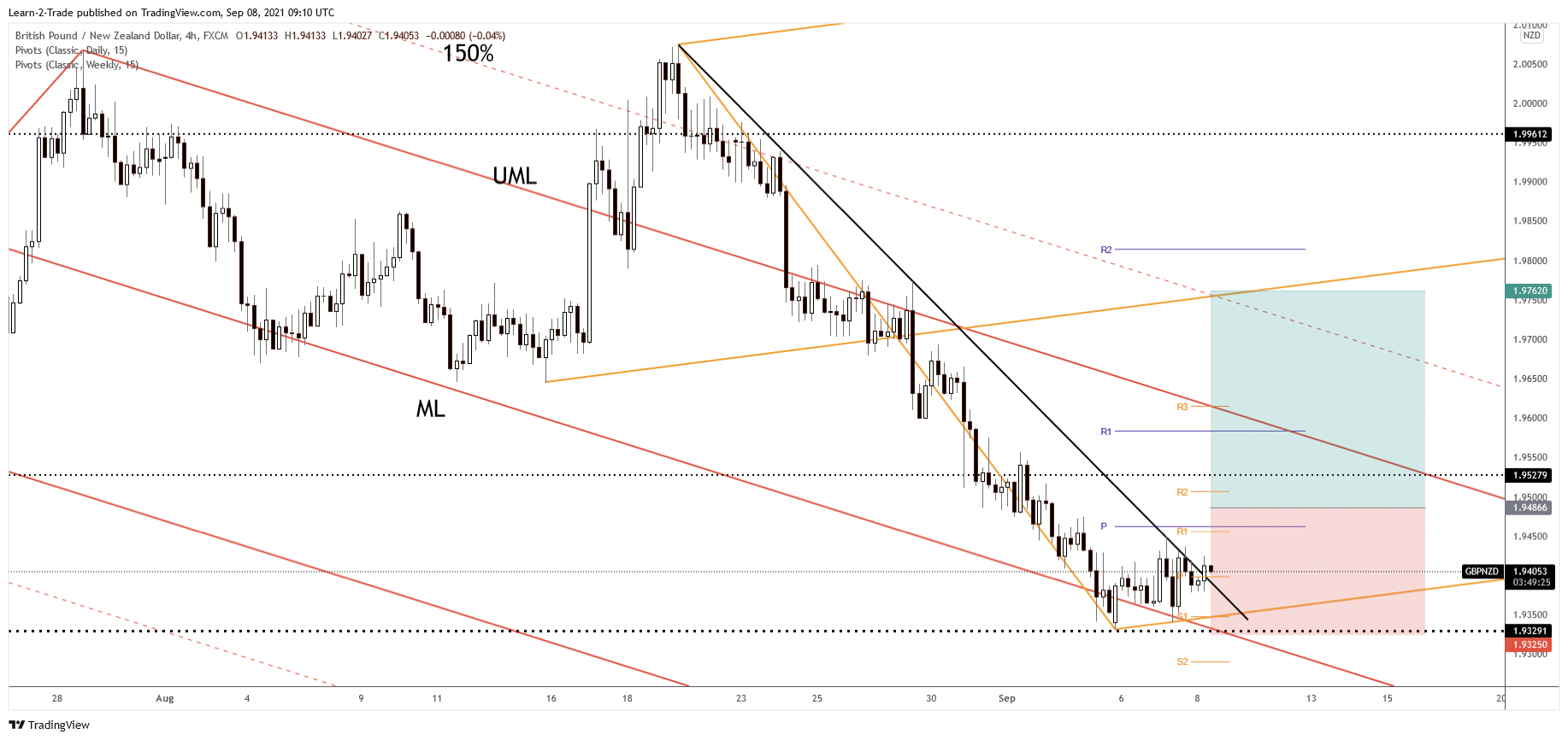

From the technical point of view, the GBP/NZD pair has found support below the descending pitchfork’s median line (ML), on the 1.9329 static support. Now it is pressuring the immediate downtrend line. A valid breakout and a new higher high could announce a potential rebound in the short term.

GBP/NZD free forex signals

My Trading Opinion in GBP/NZD

Instrument: GBP/NZD

Order Type: BUY STOP

Entry price: 1.9486

Stop Loss: 1.9325

TP1: 1.9762

My Risk: 1%

Risk / Reward Ratio: 1:1.7

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.