Our free forex signals service trade today is a buy order on the gold. The metal is looking for an upside after bouncing from the support.

The gold price slipped lower after reaching $1,948.68. The metal is trading at a $1,943.07 level. It seems determined to resume its rebound. Gold has tested the immediate support levels before extending its growth. The precious metal remains very attractive amid geopolitical tensions and due to inflationary pressure.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

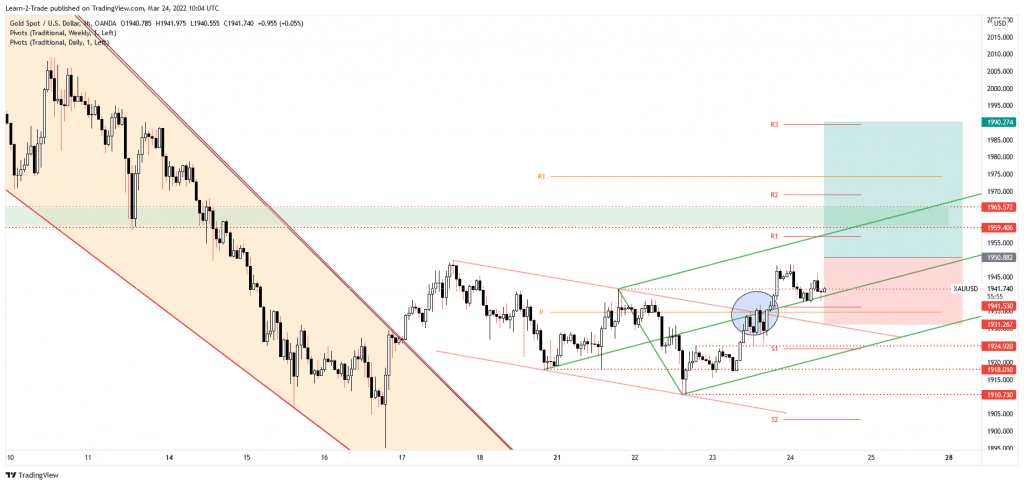

Technically, the yellow metal escaped from a down channel, from a flag pattern seen as a bullish formation. The price action signaled that the downside was over and that the buyers could take the lead again.

Fundamentally, the price of gold was also lifted by higher inflation reported by the United Kingdom. The CPI rose by 6.2% versus 6.0% expected, while the Core CPI increased by 5.2% compared to 5.0% estimates.

US manufacturing and services PMIs

Later today, the US will release important economic figures, which could also bring high volatility on XAU/USD. For example, the Flash Services PMI is expected at 56.0 below 56.5 in the previous reporting period, while the Flash Manufacturing PMI could drop from 57.3 to 56.6 points. In addition, the Unemployment Claims could drop from 214K to 210K in the last week.

In my opinion, XAU/USD could extend its growth as long as it stays above the median line of the ascending pitchfork.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Buy gold at $1,950.88

Free forex signals entry price and take-profit

Instrument: GOLD

Order Type: BUY STOP

Entry price: 1,950.88

Stop Loss: 1,931.26

TP1: 1,990.27

My Risk: 1%

Risk / Reward Ratio: 1:2

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money