Our free forex signals service today is a buy order on the NZD/JPY pair.

The NZD/JPY pair rallied in the short term and now it seems poised to develop a larger upwards movement. Still, in the short term, it has reached a resistance area, so only a valid breakout could really confirm an upside continuation.

Fundamentally, the New Zealand Inflation Expectations indicator was reported at 2.96% above 2.27% in the previous reporting period.

Yesterday, the Japanese Trade Balance was reported at -44T versus -0.60T, while the Core Machinery Orders registered only a 0.0% growth versus 1.4% expected. Tomorrow, the Japanese National Core CPI is expected to register a 0.1% growth. Check our economic calendar for details.

3 Free Forex Every Week – Full Technical Analysis

Japanese Yen Futures Bearish

Despite the Yen Futures’ rally, NZD/JPY has managed to rebound. Technically, the Japanese Yen Futures (6J1!) maintains a bearish bias, a deeper drop could signal Yen’s depreciation. Also, the JP225 (Nikkei) could resume its growth, this scenario indicates JPY’s weakness.

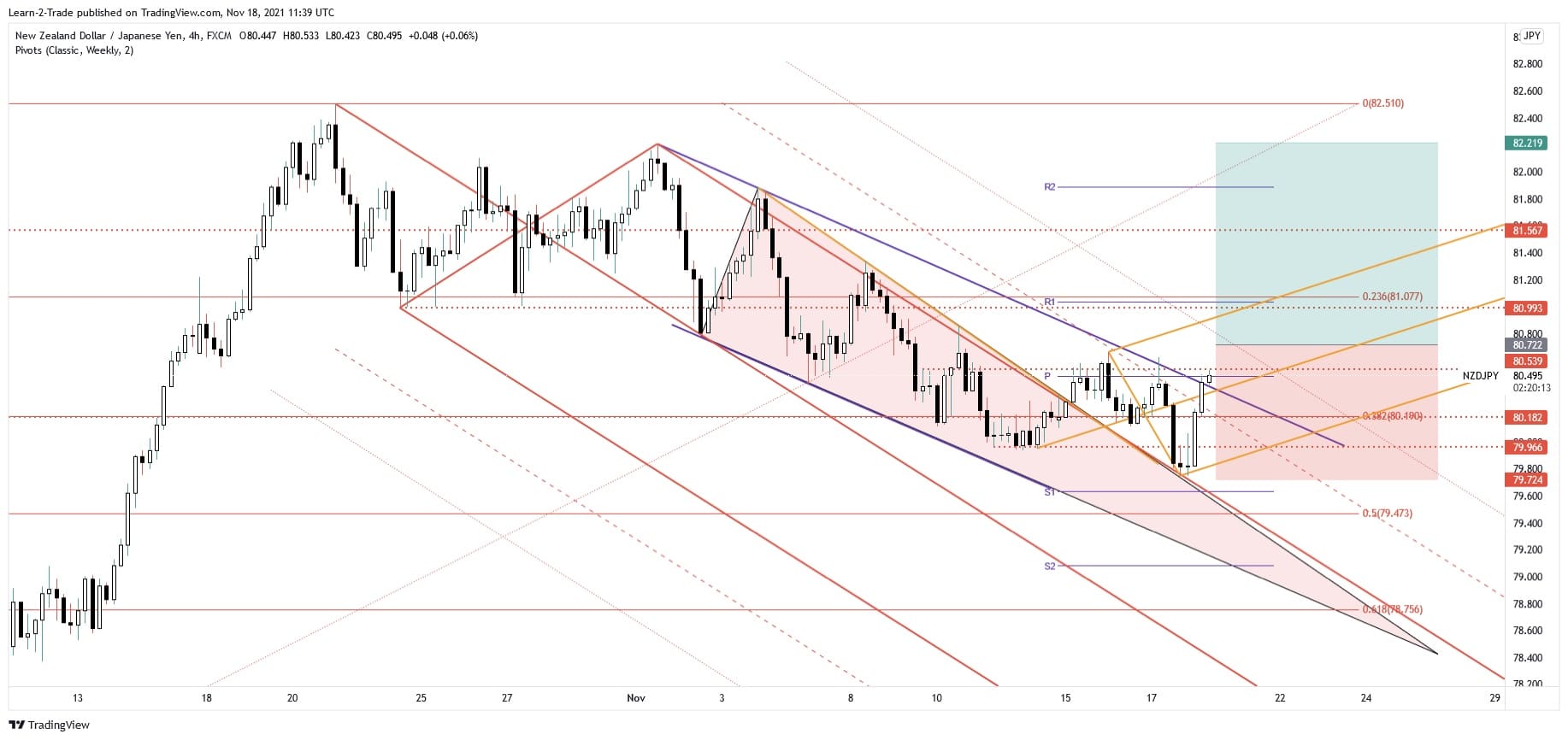

Technically, the NZD/JPY retested the Falling Wedge’s resistance and the descending pitchfork’s upper median line (uml) and now it challenges the weekly pivot point and the 80.53 static resistance. A new higher high could activate an upside continuation.

Free forex signals – BUY NZD/JPY at 80.72

Free forex signals entry price and takes profit

Instrument: NZD/JPY

Order Type: BUY STOP

Entry price: 80.72

Stop Loss: 79.72

TP1: 82.21

My Risk: 1%

Risk / Reward Ratio: 1: 1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.