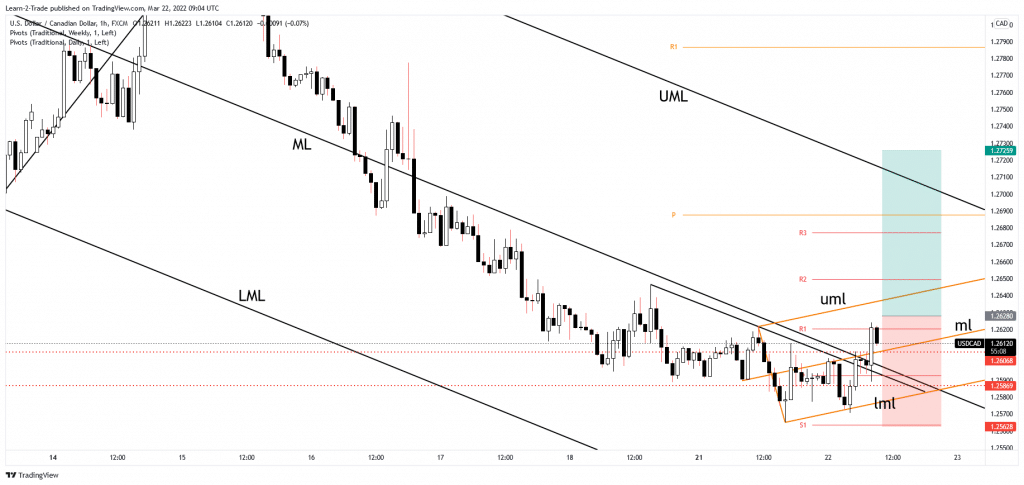

Our free forex signals service trade today is a buy order on the USD/CAD. The pair is looking for an upside after resistance breakout.

The USD/CAD pair registered an amazing sell-off. However, now it seems that the sellers are exhausted. In the short term, it moves sideways, but an upside reversal is far from being confirmed.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The Dollar Index plunged after reaching the 98.96 level. Still, this could be only a temporary drop. DXY’s upwards continuation could help the USD to appreciate versus its rivals.

The Canadian IPRI and RMPI indicators could bring some volatility in the short term. Also, the greenback may react around the Richmond manufacturing Index publication and after the FOMC Members Williams and Mester speeches.

Technically, after its massive drop, a temporary rebound is natural. The price action signaled sellers’ exhaustion, but we still need confirmation before taking action.

Fed Chair Powell speaks

Tomorrow, Fed Chair Powell will participate in a virtual panel discussion. Potential remarks about inflation and rate hikes could bring sharp movements again. From the technical point of view, the USD/CAD price could turn to the upside after failing to stay below the median line (ML). A new higher high could signal further growth, making a valid breakout above the R1. On the other hand, a new lower low could invalidate an upwards movement.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Buy USD/CAD at 1.2628

Free forex signals entry price and take-profit

Instrument: USD/CAD

Order Type: BUY STOP

Entry price: 1.2628

Stop Loss: 1.2562

TP1: 1.2725

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money