Our free forex signals service trade today is a buy order on the USD/CHF pair.

The USD/CHF pair plunged in the short term as the Dollar Index dropped deeper. Technically, the current drop could be only a temporary one after its amazing leg higher. It could test and retest the immediate support levels before starting to grow again.

As you already know, the pair dropped after the Fed Chair Powell Testifies, but it remains to see how it will react later after the US inflation data publication.

The US Dollar could still appreciate as the Dollar Index stands right above a major support zone, so a new leg higher could announce USD’s appreciation.

3 Free Forex Every Week – Full Technical Analysis

US Consumer Price Index 0.4% Expected

The USD/CHF pair is trading in the red but the US economic data could change the sentiment later today. The Consumer Price Index is expected to register a 0.4% growth in December versus 0.8% in November, while the Core CPI could report a 0.5% growth.

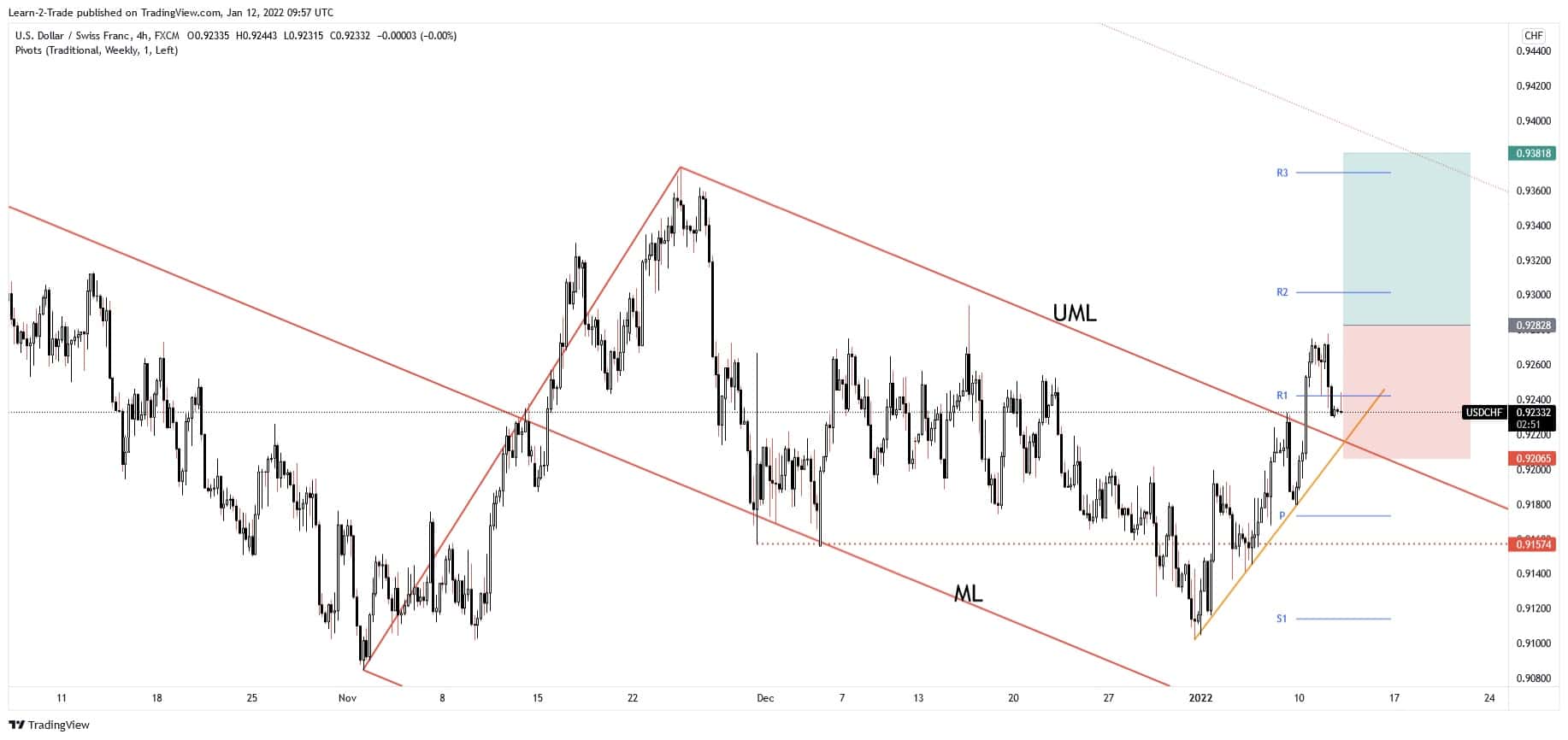

Technically, after the aggressive breakout through the descending pitchfork’s upper median line (UML), the USD/CHF pair was somehow expected to retreat a little. Staying above the uptrend line and making a new higher high could announce an upside continuation.

Free forex signals – BUY USD/CHF at 0.9282

Free forex signals entry price and takes profit

Instrument: USD/CHF

Order Type: BUY STOP

Entry price: 0.9282

Stop Loss: 0.9206

TP1: 0.9381

My Risk: 1%

Risk / Reward Ratio: 1:1.3

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.