Our free forex signals service trade today is a sell order on the USD/JPY. The pair is looking for an upside after a mild correction.

The USD/JPY pair is trading at the 115.79 level while writing. It retreated after reaching the 115.92 level in yesterday’s session. Technically, the correction is natural after an amazing rally. The currency pair could test the immediate support levels before resuming its uptrend. The price slipped lower as the Dollar Index pared gains. Still, the Yen is bearish in the short term as the Japanese Yen futures plunged.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Fundamentally, the Japanese economic data came mixed again today. The Final GDP registered only a 1.1% growth versus 1.4% expected, the M2 Money Stock rose by 3.6%, beating the 3.5% estimates, while the Final GDP Price Index fell by 1.3%, matching expectations. In addition, the Prelim Machine Tool Orders were reported at 31.6% versus 61.4% in the previous reporting period.

JOLTS Job Openings 10.96M expected

The USD needs strong support from the US economy to resume its appreciation. The JOLTS Job Openings indicator is expected at 10.96M versus 10.93M in the previous reporting period. Tomorrow, the US inflation data could really shake the markets.

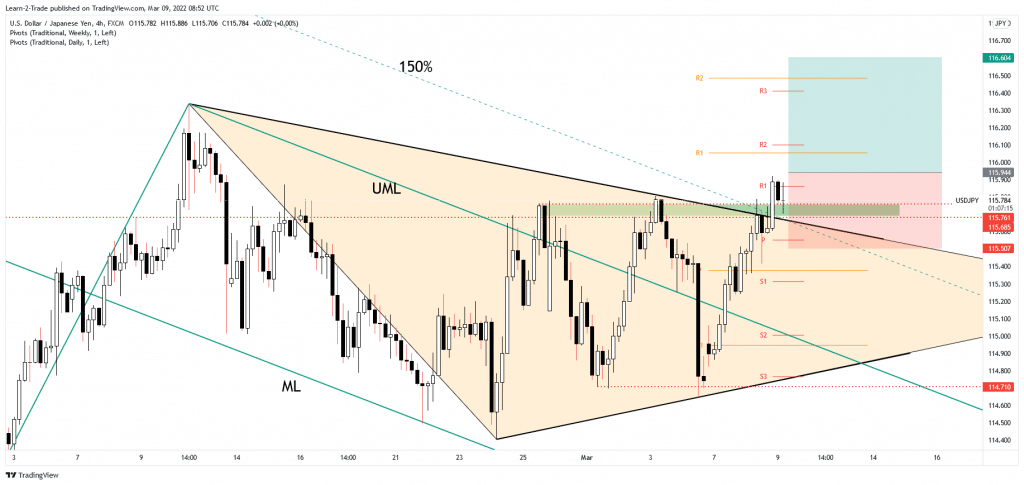

From the technical point of view, the USD/JPY pair could extend its growth if it stabilizes above the 115.68 – 115.76 broken resistance area. It could retest the broken downtrend line in the short term before jumping higher.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Buy USD/JPY at 115.94

Free forex signals entry price and takes profit

Instrument: USD/JPY

Order Type: BUY STOP

Entry price: 115.94

Stop Loss: 115.50

TP1: 116.60

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money