Today, our free forex signals service trade is a buy order in USD/MXN. The price will go up if the USD corrects lower from multi-year highs.

The USD/MXN pair drops as the Dollar Index has retreated after hitting new highs around 104.71. DXY’s retreat could force the USD to depreciate versus its rivals in the short term. Still, don’t forget that the index maintains a bullish bias despite temporary phases of corrections.

–Are you interested in learning more about making money with forex? Check our detailed guide-

As you already know, the DXY resumed its growth after the US reported higher inflation in April. The CPI rose by 0.3% versus 0.2% expected, while the Core CPI surged by 0.6% exceeding the 0.4% growth estimate. After its strong rally, the index retreated a little.

However, a minor correction could help us to catch new USD longs. In addition, the FED is expected to continue hiking rates. That’s why the greenback could dominate the currency market.

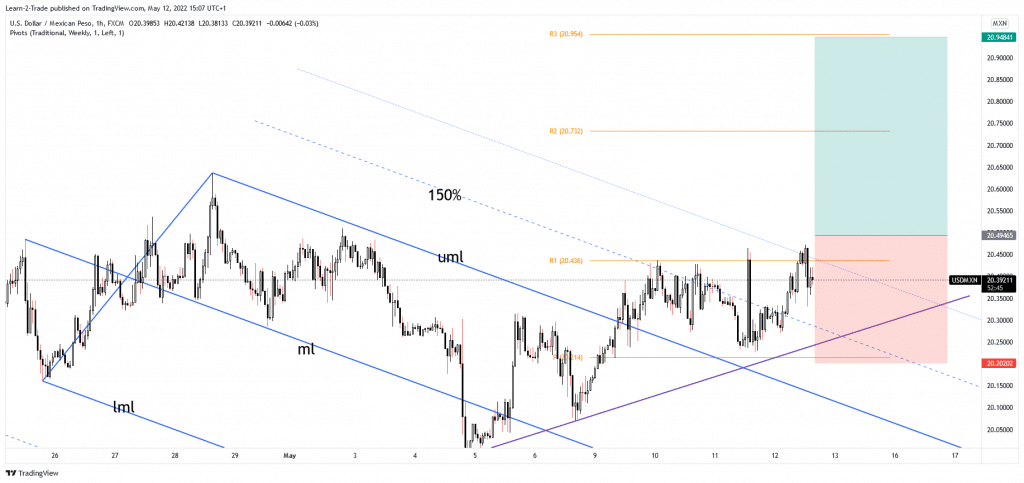

The USD/MXN pair reached a short-term resistance area. So, a temporary drop looks evident. It could return to test the support levels before developing a new leg higher.

3 Free Forex Every Week – Full Technical Analysis

US PPI 0.5% growth

Fundamentally, the US data came mixed today. The PPI reported 0.5% growth matching expectations, Core CPI registered a 0.4% growth versus 0.6% forecasts, while the Unemployment Claims came in at 203K in the last week versus 190K estimates.

From the technical point of view, the USD/MXN pair could still develop a new upwards movement as long as it stays above the uptrend line.

Free forex signals – Buy USD/MXN at 20.494

Free forex signals entry price and take-profit

Instrument: USD/MXN

Order Type: BUY STOP

Entry price: 20.494

Stop Loss: 20.202

TP1: 20.948

My Risk: 1%

Risk / Reward Ratio: 1:1.55

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money