Our free forex signals service trade today is a sell order on the AUD/JPY. The pair will go downside if the JPY finds bullish momentum.

The AUD/JPY pair remains sideways in the short term. The price action signaled that the buyers were exhausted and the bears could take the lead. Technically, the bias is bullish, but we cannot exclude a temporary correction. Still, we need strong confirmation before taking action on this market.

The Japanese Yen could appreciate versus its rivals if the Japanese Yen Futures rebound after the current massive drop. The pair is trading at 93.30 at the time of writing, above 93.07 today’s low. The Australian Dollar took a hit from the Australian data on Thursday. The Employment Change was reported at 17.9K below 30.0K estimates, while the Unemployment Rate remained at 4.0% even if the traders expected a potential drop to 3.9%.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Today, the Chinese economic data is mixed, but the Aussie remains sluggish. Tomorrow, the Japanese Revised Industrial Production will register a 0.1% growth.

Australian Monetary Policy Meeting Minutes

In the morning, the RBA will release its Monetary Policy Meeting Minutes. This report could bring high volatility and sharp movements in the AUD. Later, the CB Leading Index could bring more action.

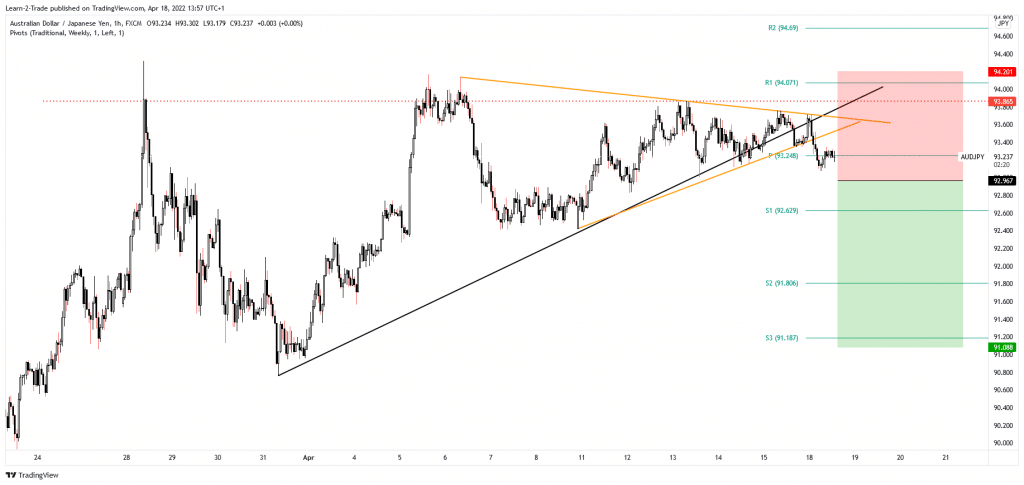

From the technical point of view, 93.86 is seen as an upside obstacle. However, a new lower low may activate a corrective phase.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell AUD/JPY at 92.96

Free forex signals entry price and take-profit

Instrument: AUD/JPY

Order Type: SELL STOP

Entry price: 92.96

Stop Loss: 94.20

TP1: 91.08

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money