Our free forex signals service trade today is a sell order on the USD/CAD. The pair will go down if it finds a reversal from the support level.

The USD/CAD pair dropped after the Dollar Index slipped lower. The DXY showed overbought signs, so a temporary retreat is natural after its strong leg is higher. The currency pair signaled that the buyers are exhausted after the price reached strong upside obstacle in the short term. At the time of writing, the pair is trying to recover after today’s drop. The bias remains bullish as the Dollar Index maintains a bullish outlook.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Fundamentally, the Canadian data came in mixed on Friday. The Unemployment Rate dropped unexpectedly lower from 5.5% to 5.3%, below 5.4% expected, while the Employment Change was reported at 72.0K below 77.5K forecasts.

US Consumer Price Index

Tomorrow, the US is to release its inflation data. The Consumer Price Index is expected to report a 1.2% growth in March versus 0.8% growth in February, while the Core CPI might post a 0.5% growth in the last month.

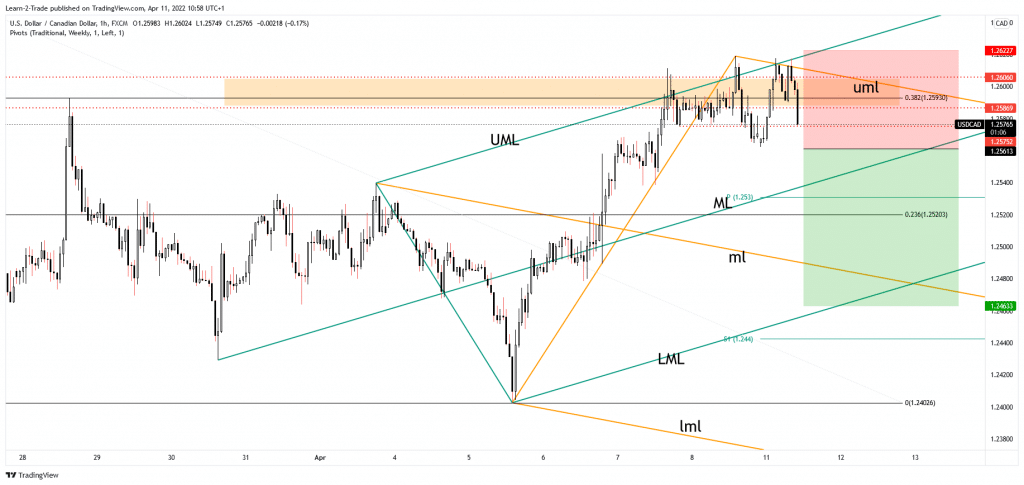

From the technical point of view, the USD/CAD pair failed to stabilize above 1.2606 static resistance. It has registered only false breakouts above this obstacle. In the short term, the rate could come back to test and retest the 38.2% retracement level and all near-term upside obstacles. Only a new lower low could really activate a new downwards movement.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell USD/CAD at 1.2561

Free forex signals entry price and take-profit

Instrument: USD/CAD

Order Type: SELL STOP

Entry price: 1.2561

Stop Loss: 1.2622

TP1: 1.2463

My Risk: 1%

Risk / Reward Ratio: 1:1.6

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money