Our free forex signals service trade today is a buy order on the USD/CAD. The pair will go down if the Bank of Canada hikes the interest rates.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

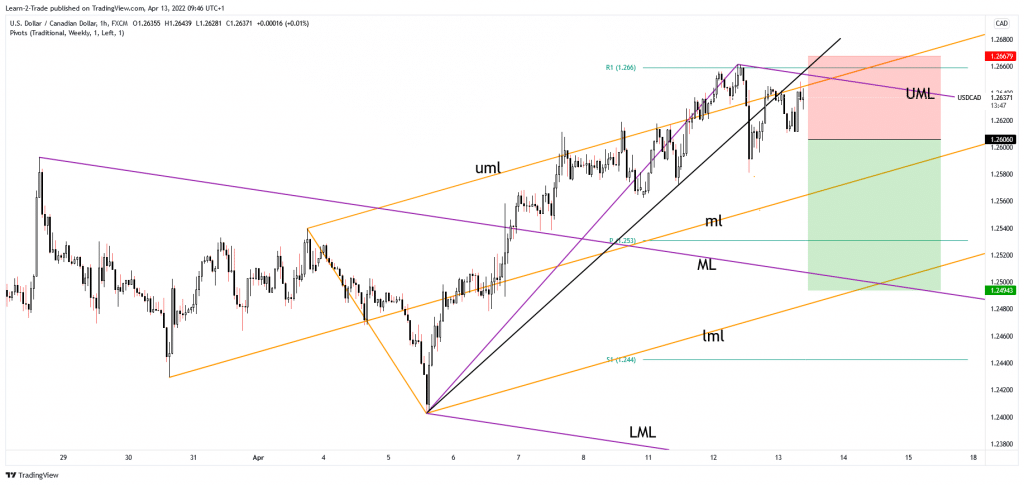

The USD/CAD pair is trading green on the hourly chart at 1.2640. The price tries to resume its upside as the Dollar Index maintains a bullish bias after the US inflation data. As long as the DXY resumes its growth, the USD could appreciate versus its rivals.

Still, the currency pair is in a resistance zone in the short term. The price action signaled a bearish divergence signaling that the buyers were exhausted. The bias is bullish. That’s why we need strong confirmation before taking action.

The US PPI is expected to register a 1.1% growth versus 0.8% expected, while the Core PPI could register a 0.5% growth in March versus 0.2% growth in February.

3 Free Forex Every Week – Full Technical Analysis

Canadian Overnight Rate 1.00% expected

Today, you need to be careful as the Bank of Canada is expected to hike the Overnight Rate from 0.50% to 1.00%. In addition, the BOC Press Conference, BOC Monetary Policy Report, and the BOC Rate Statement could really shake the markets and bring high volatility.

From the technical point of view, the USD/CAD pair could turn to the downside if it stays below the descending pitchfork’s upper median line (UML).

Free forex signals – Sell USD/CAD at 1.2606

Free forex signals entry price and take-profit

Instrument: USD/CAD

Order Type: SELL STOP

Entry price: 1.2606

Stop Loss: 1.2667

TP1: 1.2494

My Risk: 1%

Risk / Reward Ratio: 1:1.8

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money