Our free forex signals USD/CHF set-up shows the pair is on the march, even as Fed chairman Jerome Powell reaffirms the US central bank’s dovish posture.

The US dollar is stronger against all major economies, and the safe haven Swiss Franc is proving to be no exception to that. Dollar Index spot is trading at 91.74, down marginally at 0.2%.

In the statement released before his testimony to the House committee, the Fed made it clear that employment was their key concern and the “diversity” of the bounce back in the economy in terms of narrowing inequalities.

Equities took the Powell testimony as a positive, with stocks rising yesterday.

Powell stated his testimony that the Fed would be waiting to see if the data on inflation indicates that inflation might be becoming sticky than anticipated, but that there was no sign as yet that the price rises are anything other than transitory.

Powell: “We will not raise rates pre-emptively”

“We will not raise interest rates pre-emptively because we think employment is too high [or] because we fear the possible onset of inflation. Instead, we will wait for actual evidence of actual inflation or other imbalances,” Powell said.

Exactly what that evidence needs to look like for the Fed to change tack to a more hawkish stance is not clear, but CPI in the US is already running at an elevated level of 4.0%.

Regarding the economic calendar, preliminary manufacturing and services PMI will be closely watched this week to gauge how the economy is performing.

Markets have also been calmed on the interest rate front by reassurance from John Williams, the president of the New York Fed. He said on Monday that the data had not “progressed” to the extent where it would require a change in monetary policy by the Fed.

Those comments were in stark contrast to the musing of James Bullard, the president of the St Louis Fed, which seemed to take a more hawkish approach, or at least that’s how they were interpreted by the markets.

Bullard said that he thought it might be warranted for interest rates to start to tick higher next year. The FOMC has said that policy will not change on rates until end 2023 at the earliest.

Now let’s get to the signal – details below:

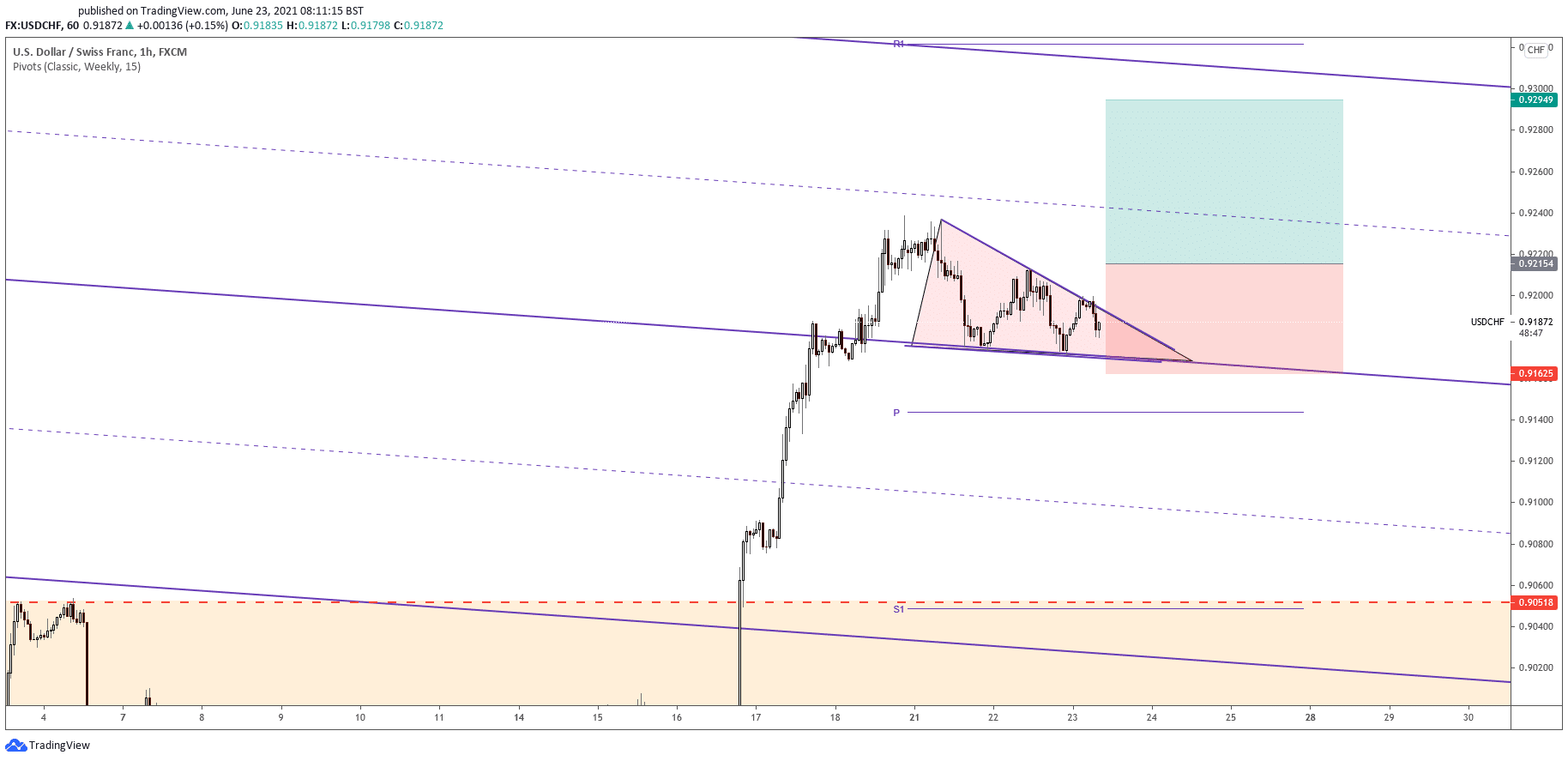

Free forex signals USD/CHF – BUY-STOP

Instrument: USD/CHF

Order: BUY STOP

Entry price: 0.9215

Stop Loss: 0.9162

TP1: 0.9294

Recommended Risk: 1%

Risk / Reward Ratio: 1:1.5

Signal validity period: Good until cancelled

Get Free Forex Signals – 82% Win Rate!

3 Free Forex Every Week – Full Technical Analysis