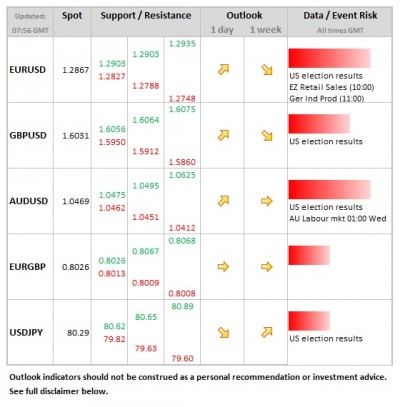

- USD: Even though the result has come through, scope for volatility remains as positions are adjusted.

- EUR: German production data of most note, given risk of further slip into recession into year-end, but weaker numbers not likely to have major impact on EUR, with USD risks dominating.

- AUD: Labour market data is out early Wednesday. After RBA kept rates on hold this week, market likely to be more sensitive to domestic data.

Idea of the Day

So it’s over, but it isn’t. Obama’s victory was stronger than expected. At the same time, the balance in the Senate has shifted slightly more towards the democrats and at present the House is looking more Republican. FX markets are notorious for being single-minded, so with the election over, it’s time to concentrate on the fiscal cliff, the impact of which starts on 1st January next year. On paper at least, this election has significantly decreased the likelihood of a workable compromise ahead of then. We’ll likely get one, but it will be painful, messy and last minute. The dollar will struggle on this, although this may take time to come through.

Latest FX News

- USD: .Dollar index is around 0.40% lower in the wake of the election result, which reflects factors such as policy gridlock, greater likelihood of Bernanke remaining head of Fed.

- GOLD: Reversing the weakness seen towards the end of last week on the back of Obama victory.

- JPY: Some volatility on the yen overnight as the initial down-move on USD/JPY was partially recovered into the European session.

- AUD: Data showed FX reserves increasing in August, with UBS also highlighting rise in deposits of foreign institutions held at the central bank increasing as well. Suggestion that RBA is “printing Aussie dollars” to satisfy demand from foreign central banks.