USD: The U.S. Dollar opened lower overall this morning in Asia, with the U.S. Dollar Index trading as low as 82.8360 before rallying back to its current level of 82.8720. U.S. Factory Orders came in at +10.5 percent, missing analyst expectations of +10.9 percent. The Fed’s Beige Book showed economic improvement in all twelve Federal Reserve districts for the second consecutive month. Today’s U.S. numbers include ADP Non-Farm Employment Change (218K), the Trade Balance (-42.5B), Weekly Initial Jobless Claims (298K), and ISM Non-Manufacturing PMI (57.3).

EUR: The Euro is trading slightly lower against the Greenback and steady against the other majors this morning after Spanish Services PMI printed at 58.1 versus 55.5 expected, while Italian Services PMI showed a reading of 49.8 versus an anticipated print of 51.7. EZ Retail Sales were also lower than expected at -0.4% versus -0.3%. Today’s numbers include German Factory Orders, which increased +4.6% m/m, significantly higher than the +1.6% reading expected, with the previous number upwardly revised from -3.2% to -2.7%. The week’s data highlight for the Eurozone, due out later today, will be the ECB’s Minimum Bid Rate Decision (0.15%) and the associated ECB Press Conference.

GBP: Sterling is trading steady against the Greenback and the Euro and higher against the commodity currencies this morning after Services PMI printed at 60.0 versus an expected reading of 58.6. Later today, the week’s highlight for Sterling will be the release of the BOE’s Official Bank Rate Decision (0.50%) and the Asset Purchase Facility (375B), along with the MPC Rate Statement.

CHF: The Swiss Franc is trading slightly lower against the U.S. Dollar and the Euro, with no Swiss economic data out yesterday or due out later this morning.

JPY: The Japanese Yen is slightly lower against the Greenback with no significant economic data out of Japan yesterday or today.

AUD: The Aussie is trading lower against the U.S. Dollar this morning despite the Australian Trade Balance showing a contracting deficit of -1.36B, versus the wider -1.77B deficit expected, although the previous number was revised down from -1.68B to -1.56B. Also out was Australian Retail Sales data, which showed a rise +0.4%, as was widely anticipated.

CAD: The Loonie is trading lower against the U.S. Dollar this morning after the BOC left its benchmark Overnight Rate at 1.0%, as was widely expected. The central bank’s Rate Statement noted that, “The global economy is performing largely as expected. The recovery in Europe appears to be faltering as the situation in Ukraine weighs on confidence. In the United States, a solid recovery seems to be back on track, with business investment now making a significant contribution to growth. Global financial conditions remain very stimulative and longer-term bond yields have eased even further.”

NZD: The Kiwi continued losing ground against the Greenback this morning, with no notable economic data from New Zealand released either yesterday or today.

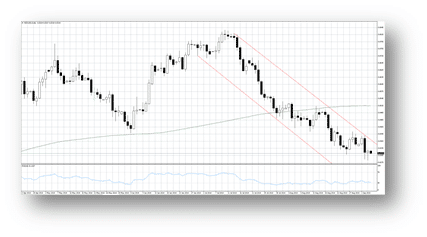

Highlighted Chart of the Day: NZD/USD

A daily bar chart of the NZD/USD currency pair appears above illustrating the prevailing downward trend within a medium term down channel bounded by the converging red trend lines. The rate is also extending its divergence below its flat 200 day Moving Average shown in green. The rate’s 14 day RSI appears in blue in the indicator box and has managed to remain out of oversold territory for the past week. (See additional technical analysis in the section below.)

Technical Analysis for the Majors

EUR/USD: The Euro remained above its 1.3114 recent low this morning, down slightly on the day but still consolidating overall. The rate is still trading well below its declining 200 day MA now at 1.3626, and its 14 day RSI remains oversold at the 27.4 level but is correcting higher. Resistance is noted at 1.3145/59 and in the 1.3220/41 region, while support shows in the 1.3131/36 and 1.3104/14 regions. Outlook is neutral in the near term but bearish medium term.

USD/JPY: USD/JPY traded below its recent 105.30 high this morning “” which lies just below resistance at 105.43 “” but it found support in the 104.75/77 region. Additional support appears in the 104.12/26 region. The rate’s 14 day RSI remains overbought at 74.4, and the rate remains above its rising 200 day MA currently located at 102.35. Outlook is near term neutral and bullish medium term.

GBP/USD: Cable failed to trade below its recent 1.6444 low but is having a down day overall. Its declining lower channel line supports the rate at 1.6399, and the rate’s 200 day MA remains flat at 1.6754. Also, its 14 day RSI remains in oversold territory at the 24.7 level. Resistance shows at 1.6496 and 1.6534, with support seen at 1.6444.Outlook isbearish in the near and medium terms.

USD/CHF: The Swissy consolidated below its recent 0.9211 high today, but it seems to have found support at the 0.9194 level from which to move higher again. The rate’s 14 day RSI lies in upper neutral territory at 63.5, and the rate is still trading considerably higher than its rising 200 day MA now situated at the 0.8939 level. Outlook is neutral in the near term but bullish medium term.

AUD/USD: The Aussie corrected lower this morning to 0.9329 after bouncing sharply off support at 0.9262 yesterday to trade as high as 0.9363, as the rate remains mired within a 0.9201 to 0.9538 medium term trading range. Its 14 day RSI lies in central neutral territory at the 51.6 level, and the rate is still trading above its nearby 200 day MA, which is now at the 0.9215 level and rising. Support is noted at 0.9262 and in the 0.9284/91 region, while resistance is seen in the 0.9322/51 and 0.9363/73 regions. Outlook has turned bullish near term and neutral in the medium term.

USD/CAD: After selling off to 1.0870 yesterday, the Loonie rose steadily this morning to reach 1.0908 thus far, but it failed to exceed recent highs in the 1.0985/96 region that offer resistance. Support is noted at 1.0870 and 1.0859. Its 14 day RSI is still located in central neutral territory at the 53.9 level, but the rate remains below its nearby 200 day MA now at 1.0937 with a flat slope. Outlook is bullish in the near term and neutral medium term.

NZD/USD: The Kiwi softened today but remained above its recent 0.8285 low made just yesterday. The rate also stayed below the falling upper trendline of its medium term down channel now re-drawn at the 0.8371 level. Its 14 day RSI has stabilized in lower neutral territory at the 33.1 level, and the Kiwi remains below its flattening 200 day MA now at 0.8515. Support is noted in the 0.8285/89 region and at 0.8309, with resistance seen in the 0.8330/46 and 0.8388/96 regions. Outlook is now bearish in the near and medium terms. (See highlighted chart above.)