Idea of the Day

The initial party in so-called ‘risk assets’ since the Fed’s decision not to start tapering asset purchases last week has faltered. In part this was on the back of comments from a Fed official late last week hinting that October tapering was a possibility. It’s noticeable that the Aussie has retraced around half of the post-decision gains, with a similar pattern for sterling although this was partly on the back of the weaker than expected retail sales data released last week. Emerging market FX has also seen the initial gains partially reversed. There is also the sceptre of German coalition negotiations dragging out over the coming weeks. The message is that markets are finding it harder to ignore the negative implications of continued asset purchases by central banks and rally regardless. This suggests that further gains for the Aussie, gold and emerging FX could struggle, even if tapering doesn’t appear in October.

Data/Event Risks

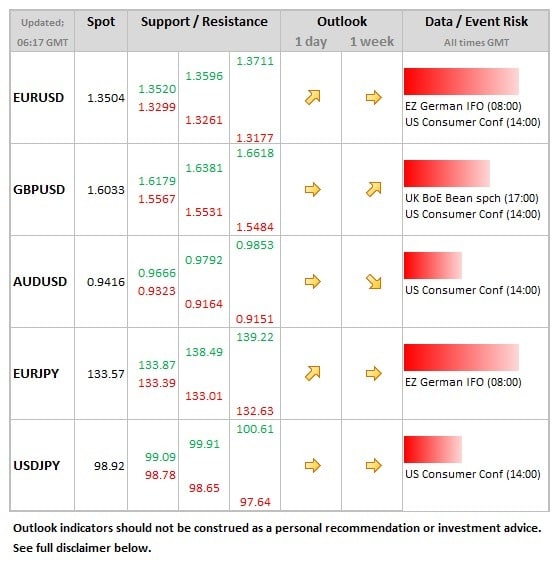

EUR: The focus remains on Germany with the release of the IFO survey, which is one of the key data releases for the euro. The market is expecting another push higher on the headline index, from 107.5 to 108.0, which would take it to the highest level for 17 months. A figure 108.5 or above would likely be sufficient to given the euro a lift, but the single currency could still prove reticent given the German political backdrop.

Latest FX News

EUR: Comments from the ECB President yesterday pushed the euro lower during late European trade, EURUSD low seen at 1.3480. He hinted that a further long-term refinancing operation is still possible. Such a move would reverse the gradual contraction of the ECB balance sheet seen this year.

AUD: Steady to lower during Asian hours, with a brief dip below the 0.9400 level. There has been a slightly heavier feel to the Aussie in the wake of the Fed’s decision not to taper asset purchases, with around half of the post-Fed gain having been erased.

GBP: Similar to the Aussie, sterling also feeling a little heavy in recent sessions, but for different reasons. Data last week bucked the trend of stronger than expected releases, so for now cable continues to struggling for air above the 1.60 level.

Further reading:

IFO Business Climate disappoints – EUR/USD slides