-

Canada’s core retail sales dropped -0.3% month-on-month in April below market consensus.

-

The Bank of Canada core inflation rose to 1.5% year-on-year, inching above expectations.

-

The GBP/CAD surged more than 100 pips on the Canadian news.

The GBP/CAD currency cross is trading at around 1.7362 up 0.31% on Thursday as the Canadian retail sales and inflation disappointed the market, additionally, the core retail sales data was also a miss.

The GBP/CAD cross find an Asian ceiling at 0.7360 and then slid down throughout the European session ahead of the Canadian data. After which the GBP/CAD jumped about 120 pips as the Candian news disappointed the market.

In fact, Canada’s retail sales month-on-month beat market’s expectations at 0.6% against 0.4% forecast in April but the core retail sales came below consensus at -0.3% against 0.5% month-on-month. However, the Bank of Canada Core Consumer Price Index (CPI) year-on-year in April came above consensus at 1.5% versus 1.4% expected by analysts. The GBP/CAD in an immediate reaction bounced more than 100 pips and is now trading in the 1.7370 region.

On the geopolitical front, the NAFTA (the North American Free Trade Agreement) deadlines have been pushed back and new dates have been confirmed yet. “The NAFTA countries are nowhere near close to a deal…. There are gaping differences. We of course will continue to engage in negotiations, and I look forward to working with my counterparts to secure the best possible deal for American farmers, ranchers, workers, and businesses,” said Robert Lighthizer, United States Trade Representative.

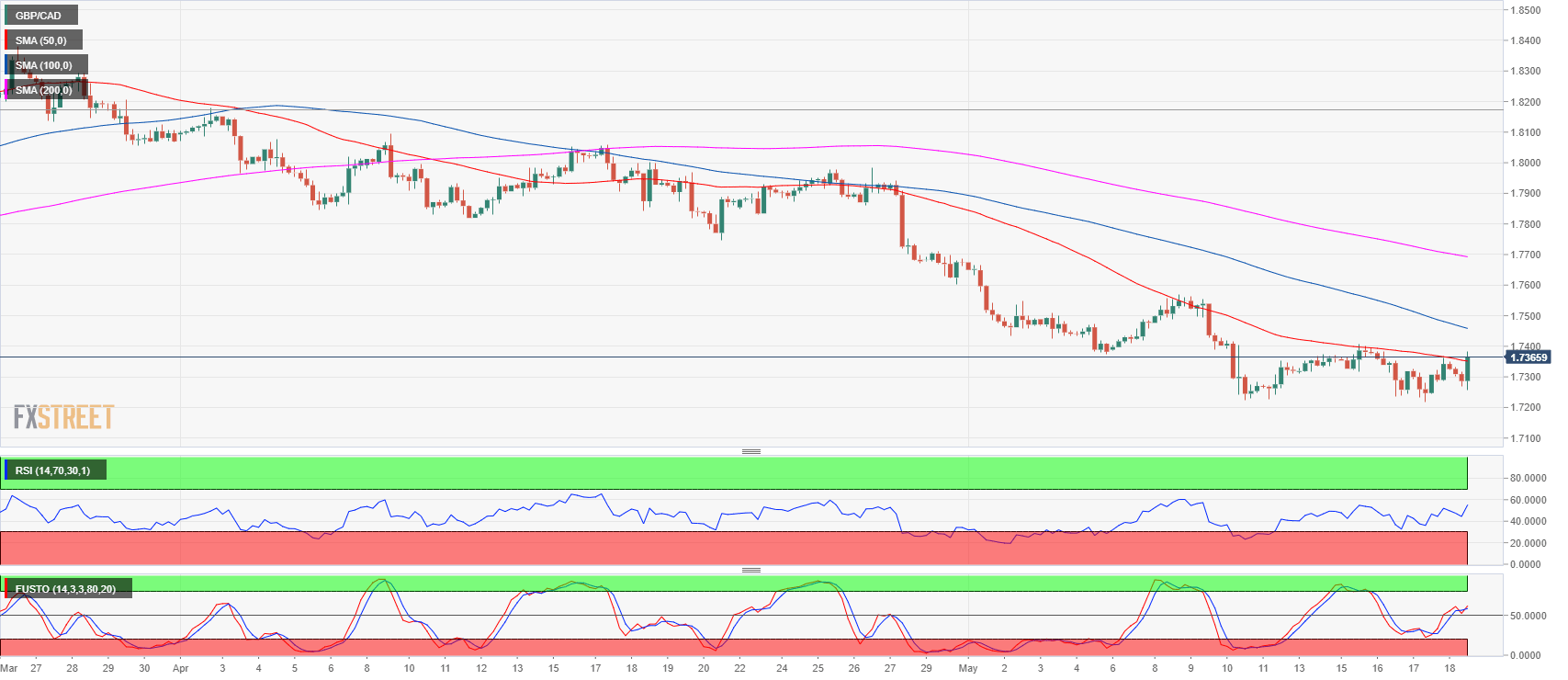

GBP/CAD 4-hour chart

The medium-term trend is bearish and supports are seen at 1.7219 swing low and at 1.7100 figure while bull will likely meet resistance at 1.7400 and 1.7500 figure. The GBP/CAD is trading below its 100 and 200-period simple moving average but just above its 50-period simple moving average on the 4-hour time-frame suggesting a downward bias.