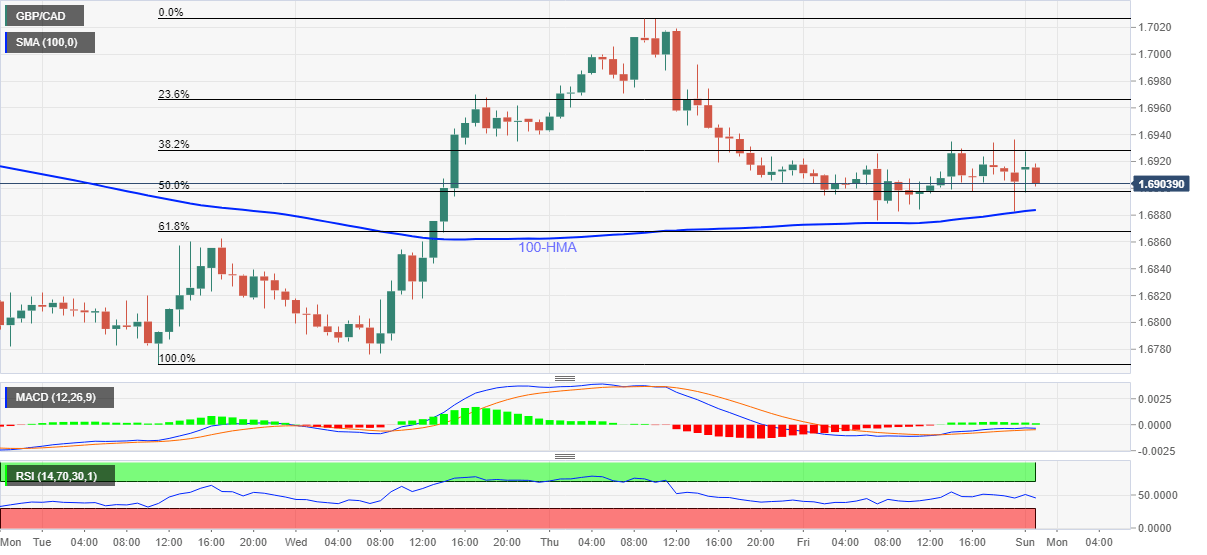

- GBP/CAD bears attack 1.6900 inside a choppy range between 1.6875 and 1.6935.

- Failure to sustain the uptick beyond the range’s resistance confronts bullish MACD.

- Sellers will have 61.8% Fibonacci retracement as an additional challenge.

GBP/CAD drops to 1.6901 amid the early Asian session on Monday. The pair began the week’s trading with an uptick to 1.6936 but couldn’t successfully clear the short-term range between 1.6875 and 1.6935. Even so, 100-HMA challenges the bears amid bullish MACD signals.

Other than the immediate support, comprising 100-HMA near 1.6880, 61.8% Fibonacci retracement of June 30 to July 02 upside, at 1.6867, could also question the sellers. Additionally, June 30 top surrounding 1.6860 might offer an extra cover to the downside.

In a case where the quote drops below 1.6860, the pair’s drop to 1.6800 and then to June 30 low near 1.6770 can’t be ruled out.

Meanwhile, a sustained upside clearance of 1.6935 enables the bulls to aim for 1.7000 threshold whereas the monthly top around 1.7030 could lure them afterward.

GBP/CAD hourly chart

Trend: Sideways