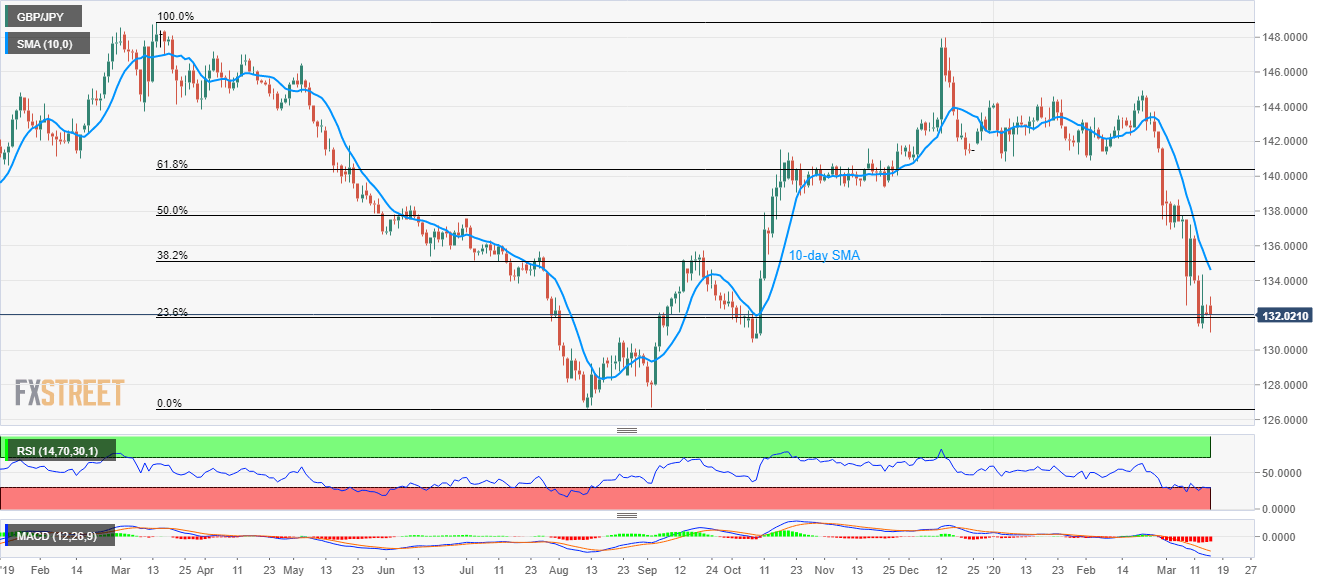

- GBP/JPY bears fail to dominate amid oversold RSI.

- 10-day SMA acts as immediate resistance, October 2019 low can offer nearby support.

- Bulls are less likely to be pleased unless flashing fresh monthly high.

GBP/JPY bounces back from five-month low to 132.15 by the press time of Tokyo open on Monday. The pair’s repeated failures to stay below 23.6% Fibonacci retracement of its March-August 2019 fall shows the sellers’ exhaustion amid oversold RSI conditions.

That said, the pair’s further pullback can aim for a 10-day SMA level of 134.62 whereas September 2019 top surrounding 135.75 may lure the buyers then after.

It should, however, be noted that the bulls are less likely to be convinced unless GBP/JPY prices manage to flash a fresh monthly top beyond 139.19.

Meanwhile, October 2019 low near 130.43 and 130.00 round-figure can question the pair’s further downside.

If at all bears refrain to relinquish their control below 130.00, 128.50 might offer an intermediate halt to the pair’s downside towards the year 2019 low close to 126.65.

GBP/JPY daily chart

Trend: Pullback expected