- GBP/JPY extends the previous day’s losses from 12-day top.

- Downside break of short-term moving average (MA) joins receding RSI.

- Monthly peak adds to the upside barrier beyond the weekly top.

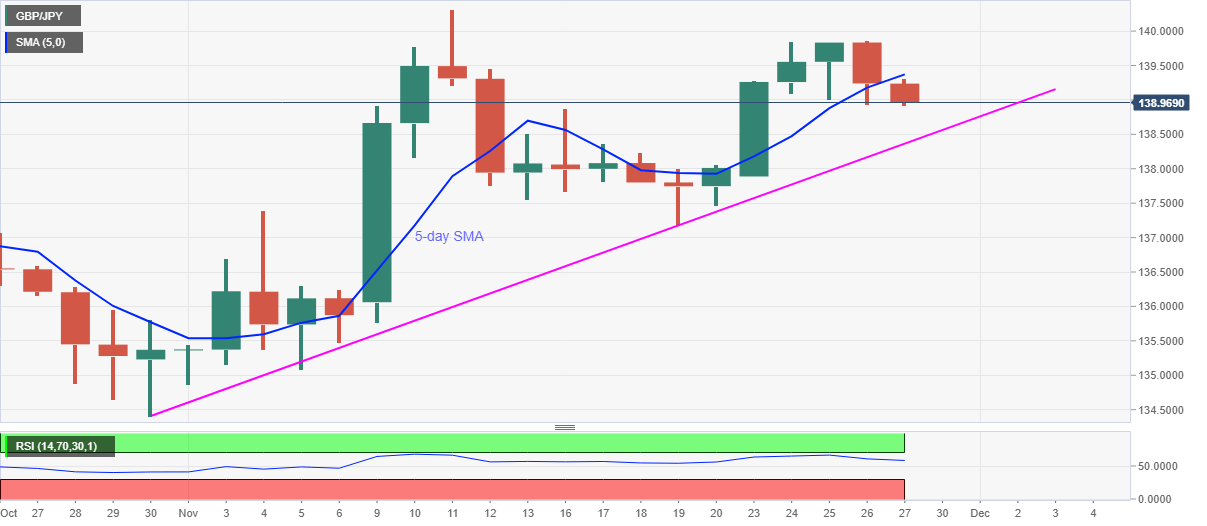

GBP/JPY bears attack 139.00, currently down 0.20% on a day near 138.95, during the pre-UK open trading on Friday. The pair surged to the highest since November 11, before declining from 139.85, the previous day.

The declines recently broke 5-day SMA (DMA) support, amid a downward sloping RSI line, which in turn suggests the quote’s further weakness towards an ascending trend line from October 30, at 138.35 now.

If at all the bears dominate past-138.35, the 138.00 round-figure and November 19 low near 137.20 will become their favorites.

Meanwhile, an upside clearance of a 5-day SMA level near 139.40 will not only need to cross the weekly top surrounding 139.85 but also the 140.00 threshold to aim for the monthly top near 140.35.

It should be noted that the pair’s sustained run-up beyond will not hesitate to challenge 141.00 whereas any further rise may look towards the yearly top near 142.70.

GBP/JPY daily chart

Trend: Further weakness expected