- GBP/JPY is in the hands of the bulls from a longer-term perspective.

- A daily correction could be on the cards to weekly support.

The following is a top-down analysis that illustrates the bullish playbook and prospects of a deeper test of the bear’s commitments in the monthly supply zone.

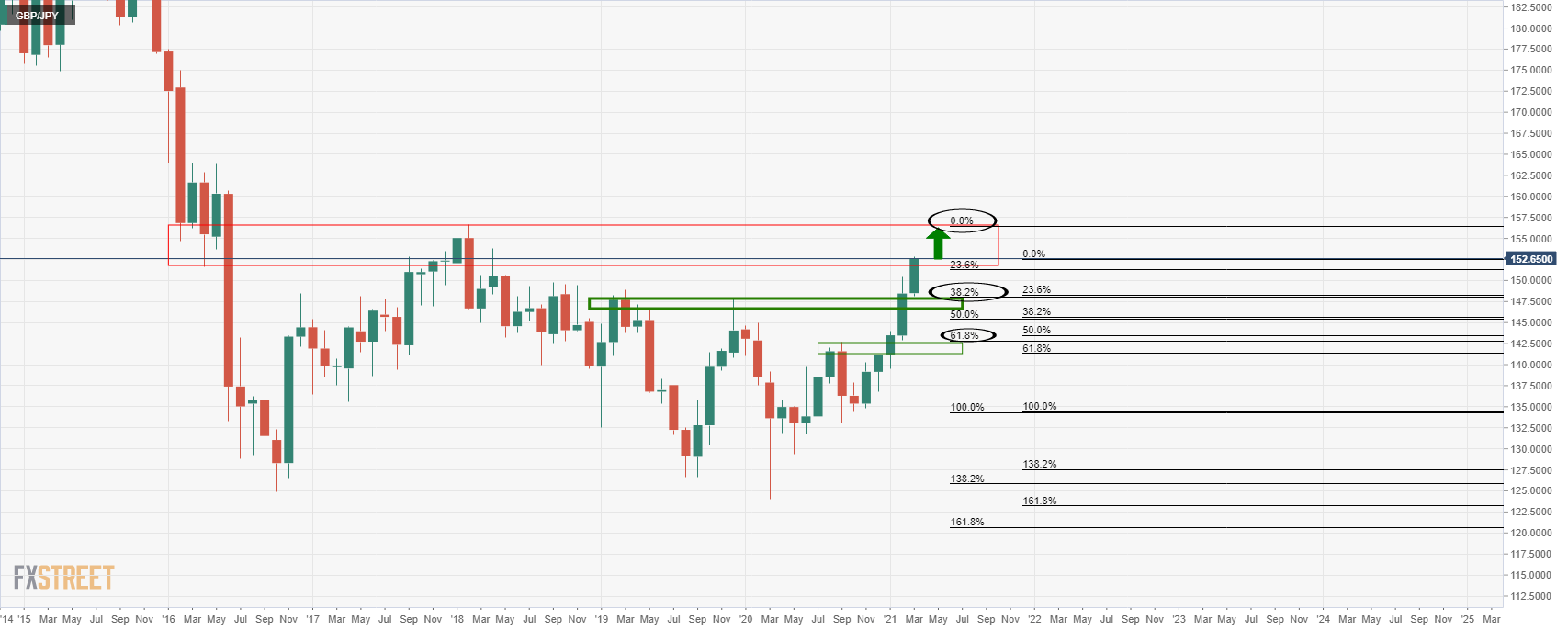

Monthly chart

The price, as it stands, is overextended on the upside and could be due for an immediate correction.

However, generally speaking, the market likes to respect the 38.2% Fibonacci on retracements.

For the 38.2% Fibonacci to align with the prior resistance structure, the bulls will need to take the cross deeper into the supply zone.

This gives rise to prospects of a weekly continuation to the upside.

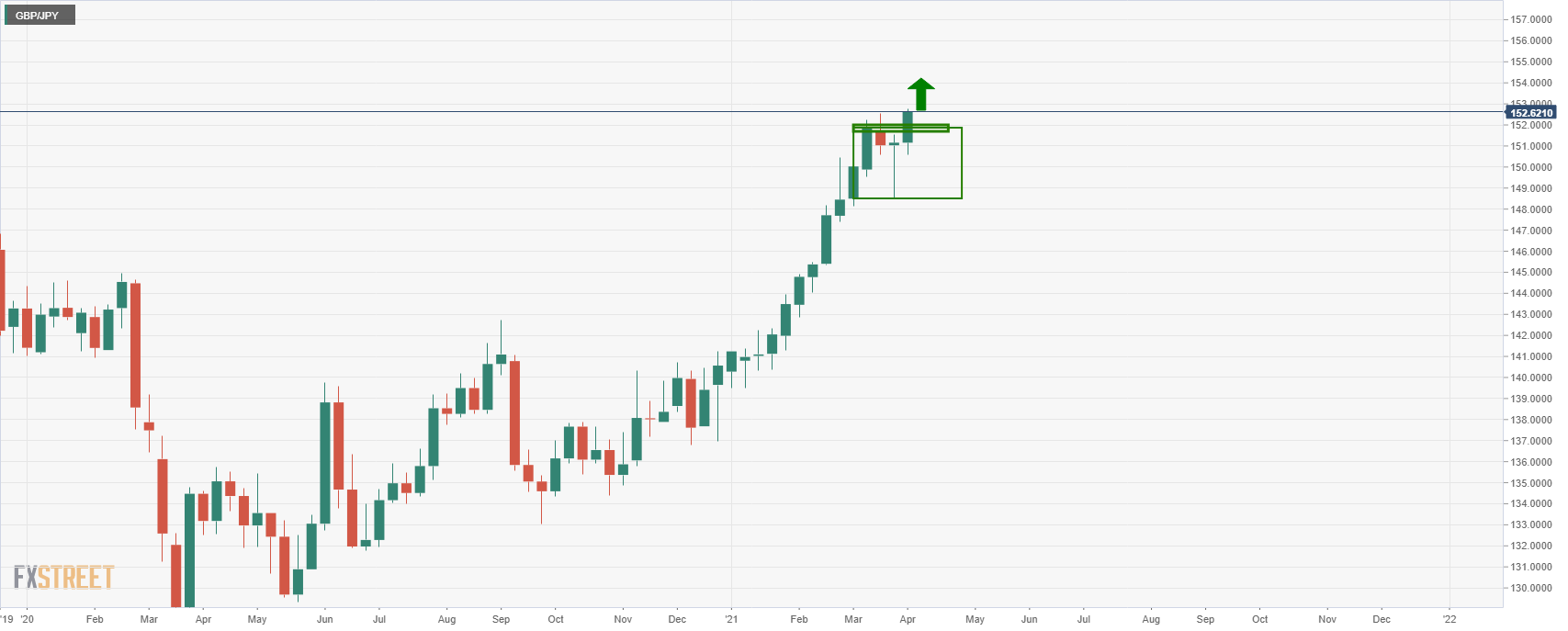

Weekly chart

As illustrated, there was a strong rejection of the downside in the prior week’s candle.

The bulls are well in control above what is now new support, old resistance.

Any daily correction would be expected to be limited to the weekly support structure which would lead to a deeper test within the monthly supply zone.

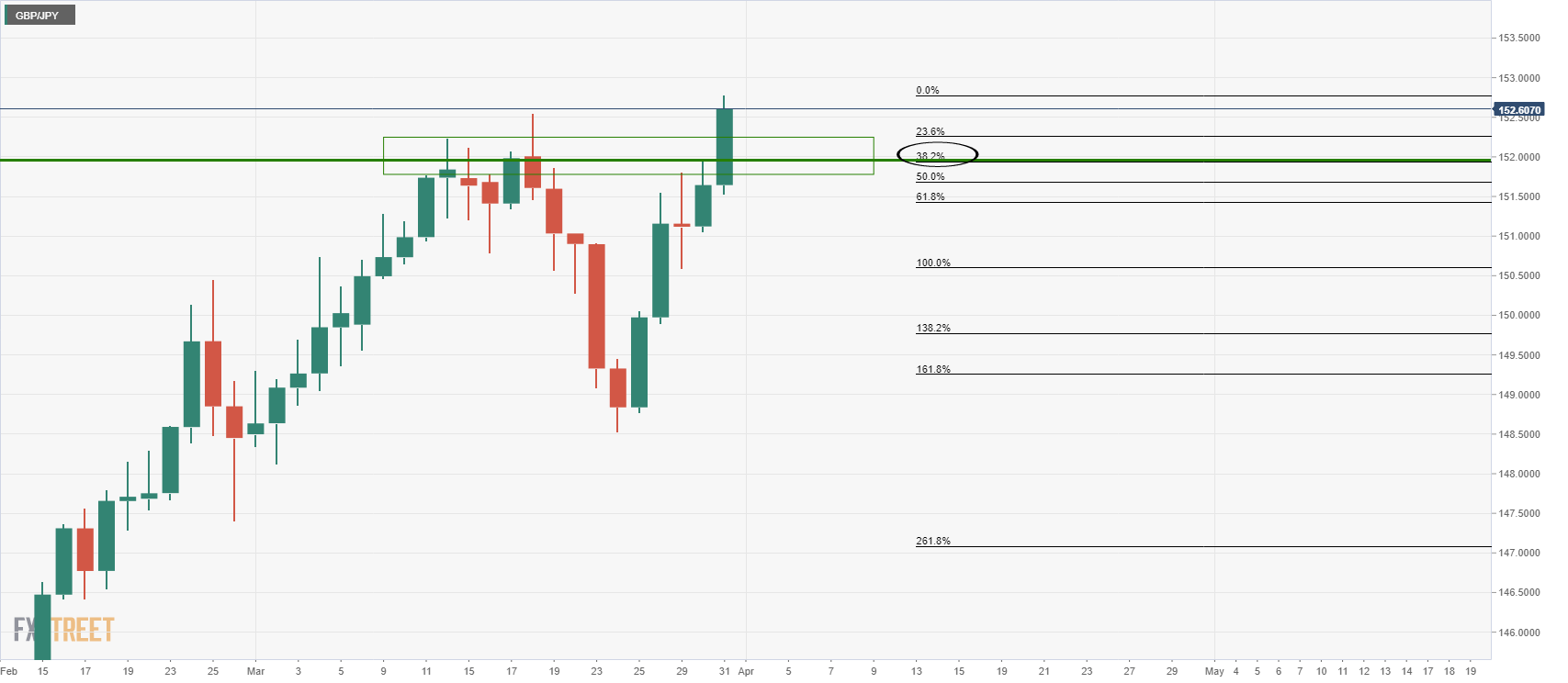

Daily chart

A daily correction could be on the cards at this juncture considering the confluence of the 38.2% Fibonacci retracement level of the latest bullish impulse with old resistance and weekly support.

In doing so, bullish demand would be expected to lift the price up towards fresh cycle highs.