- GBP/JPY remained under some intense selling pressure for the fourth straight session.

- A break below 135.60-50 support might have shifted the bias back in favour of bears.

- Mixed indicators on hourly/daily charts warrant some caution for aggressive traders.

The GBP/JPY cross witnessed some heavy selling for the fourth straight session on Thursday and dived to over one-week lows, around the key 135.00 psychological mark.

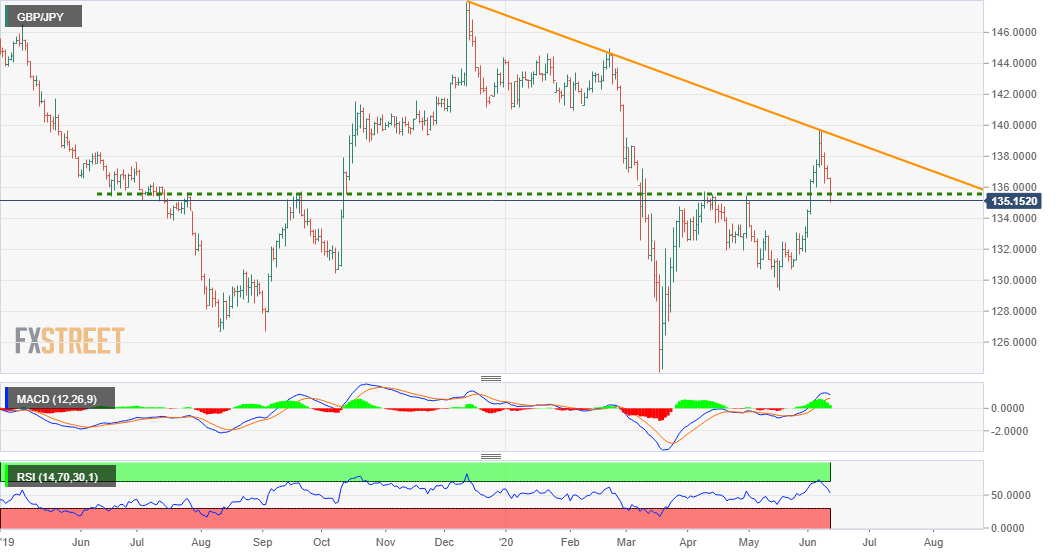

The cross extended its sharp rejection slide from a short-term descending trend-line resistance – extending from mid-December swing highs – and broke below important support near the 135.60-50 region.

Meanwhile, technical indicators on the daily chart – though have corrected from higher levels – are still holding in the bullish territory. This, in turn, warrants some caution before placing fresh bearish bets.

Moreover, oscillators on the 1-hourly chart are already flashing slightly oversold conditions and have moved on the verge of breaking below the 30.00 mark on the 4-hourly chart.

Hence, it will be prudent to wait to a sustained weakness below the 135.00 mark before traders start positioning for further weakness towards the 134.00 mark en-route the next major support near the 134.70 region.

On the flip side, the 135.50-60 support breakpoint now seems to act as an immediate resistance, above which a bout of short-covering might lift the cross back above the 136.00 mark, towards testing the 136.35-40 resistance.

GBP/JPY daily chart

Techincal levels to watch