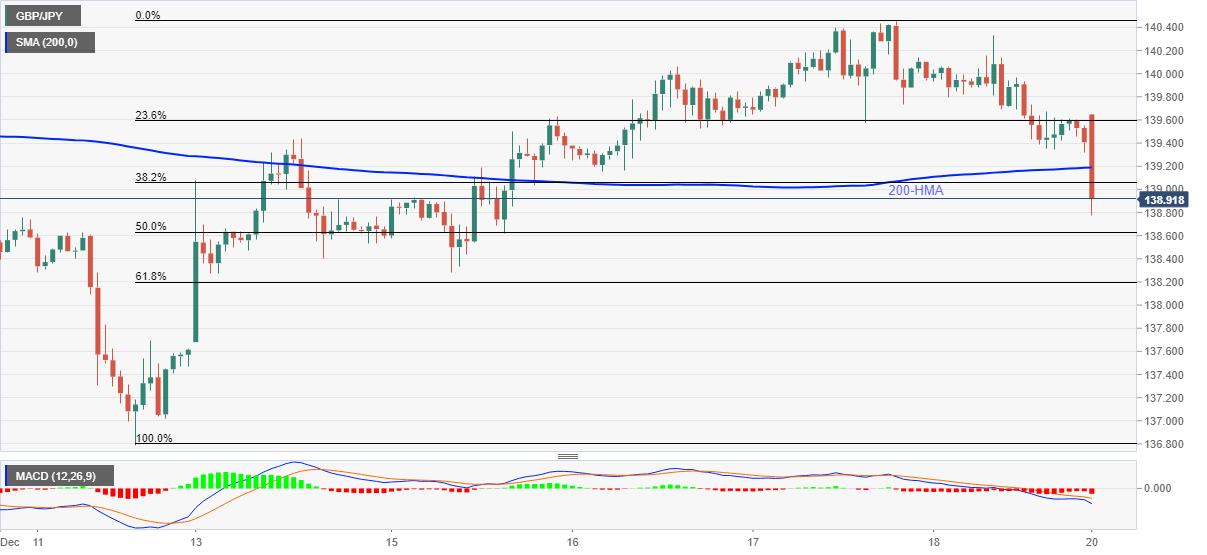

- GBP/JPY begins the week’s trading with a downside break of 200-HMA.

- Bearish MACD, fundamentals also favor sellers, bulls may wait for a fresh monthly top.

GBP/JPY drops to 138.89, after a week-start gap-down from Friday’s close of 139.40, during the early Monday morning in Asia. In doing so, the quote breaks 200-HMA support amid bearish MACD.

Not only technical indicators but bearish fundamental signals emanating from Brexit and a new coronavirus (COVID-19) variant, highlighted by the UK, also weigh on the quote.

Read: GBP/USD: Brexit woes, new covid strain hint bear’s return near 31-month high

As a result, the bears are likely to keep the reigns while eyeing December 15 low near 138.30. Though, any further downside will not hesitate to challenge the monthly bottom surrounding 136.80.

It should also be noted that any further weakness past-136.80 can drive GBP/JPY bears toward October low near 134.40.

Meanwhile, the 140.00 threshold can guard the pair’s immediate upside ahead of the monthly top near 140.70.

In a case where the bull’s return and manage to cross 140.70 on daily closing, September’s peak of 142.71 will flash on their radar.

GBP/JPY hourly chart

Trend: Further downside expected