- GBP/JPY steps back from the monthly high.

- 50% Fibonacci retracement back in focus.

- Mid-December 2019 lows will be on buyers’ radars during further upside.

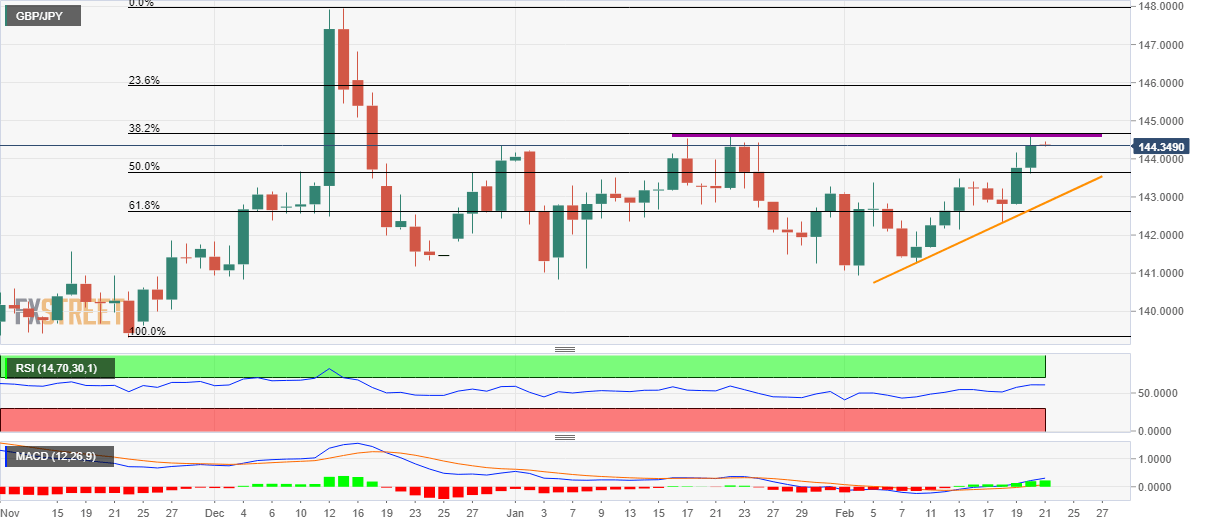

Having registered one more failure to cross 144.60 the previous day, GBP/JPY pulls back to 144.35 amid the Asian session on Friday.

While considering the upbeat signals from MACD and RSI, GBP/JPY prices are likely to keep the strength. However, a sustained break of 144.60 will need to be validated by a daily closing beyond 144.66 comprising 38.2% Fibonacci retracement of November-December 2019 upside.

Should that happen, the quote can quickly rise towards December 13 low near 145.46 and 23.6% Fibonacci retracement level of 145.92 ahead of challenging the year top near 148.00.

Alternatively, 50% Fibonacci retracement, at 143.65, gains the counter-trend traders’ attention.

However, an upward sloping trend line from February 10, at 142.84 now, can question the sellers afterward.

GBP/JPY daily chart

Trend: Bullish