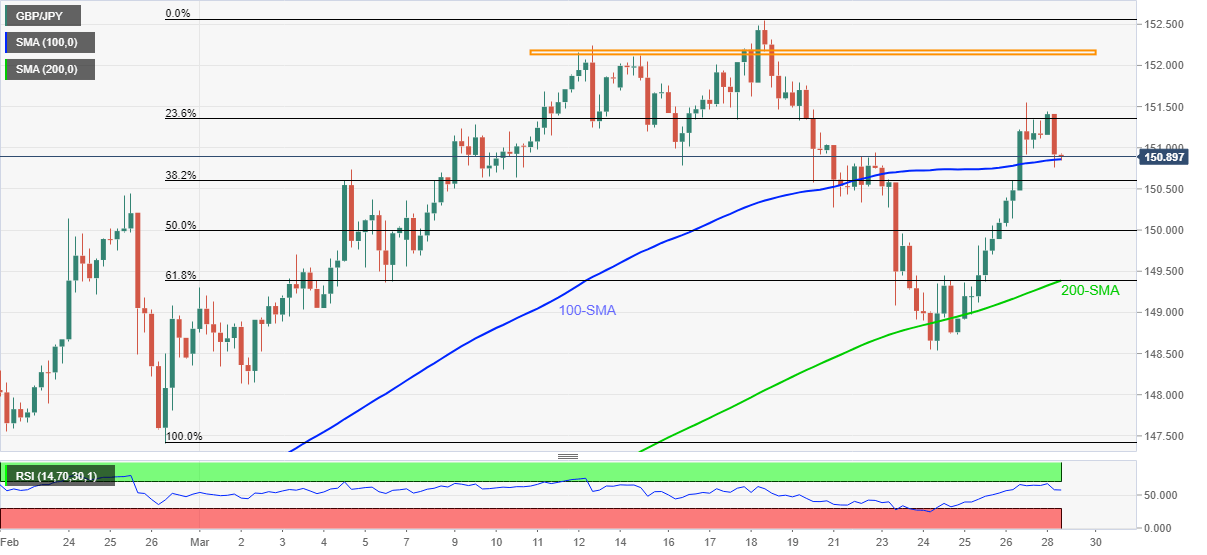

- GBP/JPY fades Friday’s recovery moves, mildly offered by the press time.

- 100-SMA tests immediate downside, a confluence of 200-SMA and 61.8% Fibonacci retracement becomes the key.

- Two-week-old horizontal area adds to the upside filters.

GBP/JPY bears attack 100-SMA while declining to 150.90, down 0.17% intraday, ahead of Monday’s European session. In doing so, the quote fades Friday’s run-up but stays bullish amid strong RSI.

However, an upside clearance of the latest high near 151.55 becomes necessary for the GBP/JPY prices before recalling the buyers.

Following that a horizontal area comprising multiple tops marked since March 12, around 152.20 will be in the spotlight as a break of which could refresh monthly top past-152.55.

Meanwhile, a downside break of 100-SMA level of 15.86 can drag GBP/JPY to 50% Fibonacci retracement level of February 26 to March 18 upside, around 150.00.

Though, GBP/JPY bears will have a tough time breaking 149.40-35 support confluence as it comprises 200-SMA and 61.8% Fibonacci retracement level.

Overall, GBP/JPY looks set to refresh the monthly top but the current pullback may revisit the key support if breaking immediate rest-point.

GBP/JPY four-hour chart

Trend: Bullish